April 10, 1948 – April 14, 2024 WAVES — Ronald H. Williams was born on April 10, 1948, in Manteo, NC, and peacefully passed away on April 14, 2024, at the age of 76 in Waves, NC. A man of few words, Ronald had the biggest impact on the lives of those around him. Retired [...]

Obituaries | Full Article

Featured Outer Banks News

What's New

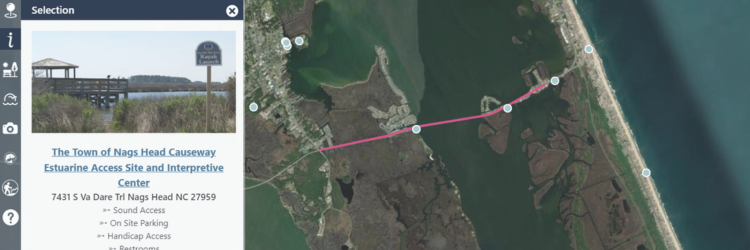

Dare County has released a new video highlighting the Dare County Recreation Map, a unique interactive resource that allows users to locate a variety of different attractions and amenities throughout Dare County—including area beach accesses, boat launches, dog parks, picnic areas, fishing piers, ball fields, walking trails and so much more. “We created the Recreation [...] Island Features | Full ArticleBagheera, a cold-stunned Hawksbill Sea Turtle found in Avon, is ma ...

April 17, 2024 | Island Features | By: Joy Crist

A rare and cold-stunned Hawksbill Sea Turtle that was rescued in Avon over the winter is on its way to making a full recovery, per a social media update from the North Carolina Aquarium on Roanoke Island. The male Hawksbill Sea Turtle, named Bagheera, was discovered along the Pamlico Sound in Avon in December 2023 [...] Island Features | Full ArticleOcracoke’s pristine beaches, maritime nature trails, village gardens, glorious live oaks, and thriving wildlife inspire residents and visitors alike to appreciate and celebrate our beautiful island’s natural places. This year, to share the love of the island and the rest of the planet, the Ocracoke community is organizing the first annual Ocracoke Earth Day Weekend [...] Island Features | Full ArticleThe N.C. Division of Marine Fisheries is looking for commercial and recreational fishermen, scientists and other interested parties to sit on the Shellfish Fishery Management Plan Advisory Committee, specifically for Eastern oyster and hard clam. The committee will assist the division in developing Amendment 5 to the N.C. Oyster Fishery Management Plan and Amendment 3 to the [...] Fishing | Full ArticleMeet the Outer Banks SPCA pet of the week, courtesy of their latest video produced by Dare County’s CURRENT TV. For more information on this pet, and the many other Outer Banks pets currently up for adoption, visit the Outer Banks SPCA website at https://www.obxspca.org/, or their Facebook page at https://www.facebook.com/obxspca/NAMI OBX Established to Support Mental Health in the Outer Banks

April 17, 2024 | Community News Brief

NAMI OBX, an affiliate of the National Alliance on Mental Illness (NAMI) announces the formation of an Outer Banks chapter to provide additional support mental health programs for adults and adolescents living with mental health issues in our communities from Corolla to Ocracoke. This chapter was made possible by community members who have been affected [...] Community News Brief | Full ArticleSELC joins Buxton Civic Association to push for action at Buxton Beach

April 16, 2024 | Local News | By: Joy Crist

The Buxton Civic Association has joined forces with the Southern Environmental Law Center (SELC) to push for the immediate remediation of a 500-yard section of Buxton shoreline. The Buxton Civic Association (BCA) was formed in early April to create a united community voice for the growing public safety and environmental issues that have stemmed from [...] Local News | Full ArticleA line of clouds created an impressive show on the Outer Banks on Tuesday morning, April 16, which was caught on camera by a number of Hatteras Island residents and visitors. “Cool wave clouds called an undular bore moved across the Outer Banks this morning,” stated Brad Panovich, Chief Meteorologist for WCNC-TV, in a trending [...] Local News | Full ArticleFAQs for Buxton Beach added to Cape Hatteras National Seashore’s ...

April 16, 2024 | Seashore News | By: Joy Crist

The Cape Hatteras National Seashore (CHNS) has added a new FAQ section to its Buxton Beach webpage in order to provide essential information on the evolving public safety and environmental issues that are occurring along a 500-yard stretch of Buxton shoreline. “Frequently asked questions for the Buxton Beach Access closure were developed by [the] Cape [...] Seashore News | Full ArticleCoastal property owners yet to embrace roof-girding grants

April 16, 2024 | Real Estate | By: Catherine Kozak

From CoastalReview.org Maybe one North Carolina insurance provider should join the industry trend and advertise: “Hello Beach Plan policyholders! Do you need a new roof? Want to save on your property insurance? How about we help you out with as much as $8,000 toward a much stronger roof that is fortified to withstand storms? And [...] Real Estate | Full ArticleHatteras Island Community Strings will host a Spring Recital on Ap ...

April 16, 2024 | Community News Brief | By: Joy Crist

Hatteras Island Community Strings will host a Spring Recital on Tuesday, April 16, at 5:30 p.m., and the public is welcome to attend this free event at the Avon Volunteer Fire Department on Harbor Road. The recital will feature the students who are receiving free music lessons at St. John United Methodist Church (UMC) with [...] Community News Brief | Full ArticleWork underway to repair and replace sandbags on Ocracoke Island; S ...

April 18, 2024 | Local News | By: Joy Crist

A project to repair and replace sandbags along N.C. Highway 12 on the north end of Ocracoke Island is underway, and a single-lane closure is in effect due to the ongoing work, per an update from the North Carolina Department of Transportation (NCDOT). “While work is in progress, there will be a short single-lane closure [...] Local News | Full ArticleNC State researchers predict active 2024 hurricane season

April 18, 2024 | Local News | By: Sam Walker

From SamWalkerOBXNews.com The 2024 Atlantic hurricane season begins in less than two months, and already a pair of preseason predictions are calling for it to be a busy one. On the heels of researchers at Colorado State University making their highest-ever early call for the number of hurricanes, a team at N.C. State University is [...] Local News | Full ArticleWork underway to repair and replace sandbags on Ocracoke Island; S ...

April 18, 2024 | Local News | By: Joy Crist

A project to repair and replace sandbags along N.C. Highway 12 on the north end of Ocracoke Island is underway, and a single-lane closure is in effect due to the ongoing work, per an update from the North Carolina Department of Transportation (NCDOT). “While work is in progress, there will be a short single-lane closure [...] Local News | Full ArticleNC State researchers predict active 2024 hurricane season

April 18, 2024 | Local News | By: Sam Walker

From SamWalkerOBXNews.com The 2024 Atlantic hurricane season begins in less than two months, and already a pair of preseason predictions are calling for it to be a busy one. On the heels of researchers at Colorado State University making their highest-ever early call for the number of hurricanes, a team at N.C. State University is [...] Local News | Full ArticleSELC joins Buxton Civic Association to push for action at Buxton Beach

April 16, 2024 | Local News | By: Joy Crist

The Buxton Civic Association has joined forces with the Southern Environmental Law Center (SELC) to push for the immediate remediation of a 500-yard section of Buxton shoreline. The Buxton Civic Association (BCA) was formed in early April to create a united community voice for the growing public safety and environmental issues that have stemmed from [...] Local News | Full ArticleA line of clouds created an impressive show on the Outer Banks on Tuesday morning, April 16, which was caught on camera by a number of Hatteras Island residents and visitors. “Cool wave clouds called an undular bore moved across the Outer Banks this morning,” stated Brad Panovich, Chief Meteorologist for WCNC-TV, in a trending [...] Local News | Full ArticleFederal grant to pay for study of N.C. Highway 12 on Pea Island

April 15, 2024 | Local News | By: Sam Walker | 2

From SamWalkerOBXNews.com A federal grant aimed at improving transportation resiliency will pay for a study of options for the future of N.C. 12 between Oregon Inlet and Rodanthe. The U.S. Department of Transportation recently announced as part of the Bipartisan Infrastructure Law that $1.8 million has been earmarked for the study of the 11-mile section [...] Local News | Full ArticleNorth Carolina’s first Wawa opens May 16 in Kill Devil Hill

April 14, 2024 | Local News | By: Sam Walker

From SamWalkerOBXNews.com North Carolina’s first Wawa opens May 16 in Kill Devil Hills The long-awaited arrival of Wawa convenience stores to North Carolina will happen next month in Kill Devil Hills. The Pennsylvania-based chain has announced the doors will open at 1900 North Croatan Highway on Thursday, May 16, at 8 a.m., with a ribbon [...] Local News | Full ArticleUPDATE: N.C. Highway 12 has reopened on northern Ocracoke Island as of 5:00 p.m. on Friday, and ferry service has resumed, per an update from the North Carolina Department of Transportation (NCDOT). “Good news! NC12 on the north end of Ocracoke reopened at 5 pm today.,” stated NCDOT in a social media update. “NCDOT removed [...] Local News | Full ArticleUncle Eddy’s in Buxton significantly damaged in early morning fire

April 12, 2024 | Local News | By: Joy Crist

The main building at Uncle Eddy’s Frozen Custard and Mini Golf at 46878 N.C. Highway 12 in Buxton was severely damaged by a fire that occurred in the early morning hours of Friday, April 12. The Buxton Volunteer Fire Department (VFD) was dispatched at 12:13 a.m. on Friday, and Hatteras and Frisco VFDs, as well as the [...] Local News | Full ArticleThe Hatteras-Ocracoke ferry operations have been suspended due to deteriorating weather conditions as of Thursday at 7:15 p.m., per an update from the North Carolina Department of Transportation’s Ferry Division. Ferry service will resume once weather conditions improve, however, N.C. Highway 12 on northern Ocracoke Island may be affected by oceanside flooding, as a coastal storm continues [...] Local News | Full ArticleNew Buxton Civic Association outlines the work ahead to fix Buxton ...

April 11, 2024 | Local News | By: Joy Crist

Members of the new Buxton Civic Association (BCA) introduced themselves to the local community at a public meeting on Wednesday that became heated at times due to its focus on the growing environmental and public safety issues at Buxton Beach. Cape Hatteras National Seashore Superintendent David Hallac attended the meeting alongside five BCA Board Members, [...] Local News | Full ArticleCoastal Flood Advisory, High Surf Advisory, Gale Warning in effect ...

April 11, 2024 | Local News | By: Joy Crist

A strong frontal system will impact the Outer Banks from Thursday into Friday, bringing the potential for severe thunderstorms, gusty winds, and possible coastal flooding. A Coastal Flood Advisory has been issued for the Outer Banks from 5:00 p.m. Thursday until 5:00 p.m. Friday, while a High Surf Advisory will be in effect from 8:00 [...] Local News | Full ArticleDare County and Currituck County—along with each county’s incorporated communities—are currently in the process of updating the Outer Banks Regional Hazard Mitigation Plan in an effort to better protect people and property from the potential effects of natural and human-caused hazards. This plan update is required for all communities to maintain their eligibility to receive [...] Local News | Full ArticleA strong frontal system will impact the Outer Banks from Thursday into Friday, bringing the potential for severe thunderstorms, gusty winds, and possible coastal flooding. A Coastal Flood Advisory has been issued for the Outer Banks from 5:00 p.m. Thursday until 5:00 p.m. Friday, while a High Surf Advisory will be in effect from 8:00 [...] Local News | Full ArticleBuxton Civic Association will host its first meeting on April 10 t ...

April 9, 2024 | Local News | By: Joy Crist

The recently established Buxton Civic Association (BCA) will host its first-ever public meeting on Wednesday, April 10, to discuss the evolving situation at Buxton Beach, as well as the next steps for facilitating action to clean up petroleum-contaminated soils, abandoned infrastructure, and other pollutants in the area. Wednesday’s meeting, (which will be held at the [...] Local News | Full ArticleFAQs for Buxton Beach added to Cape Hatteras National Seashore’s webpage

April 16, 2024 | Seashore News | By: Joy Crist

The Cape Hatteras National Seashore (CHNS) has added a new FAQ section to its Buxton Beach webpage in order to provide essential information on the evolving public safety and environmental issues that are occurring along a 500-yard stretch of Buxton shoreline. “Frequently asked questions for the Buxton Beach Access closure were developed by [the] Cape Hatteras National Seashore after attending multiple public meetings on the topic, and speaking with many members of the Outer Banks community,” stated Michael Barber, Public Affairs Specialist for CHNS. “We plan to continue speaking with the public about the formerly used defense site and will provide updates at go.nps.gov/buxtonbeach.” A small section of beach has been closed to the public since September 2023 when two offshore hurricanes – Franklin and Idalia – brushed the Outer Banks, exposing abandoned infrastructure from [...] Seashore News | Full Article

Bodie Island Lighthouse opens for climbing on April 19

April 15, 2024 | Seashore News | By: Joy Crist

The Bodie Island Lighthouse, recognized by its unique horizontal black and white stripes, will open for climbing this year beginning Friday, April 19. Climbing tickets go on sale at 7 a.m. and may only be purchased on the same day of your intended climb. Tickets are only available for purchase at www.recreation.gov/ticket/252034/ticket/10087143. Pro tip: Create your www.recreation.gov account [...] Seashore News | Full ArticleNational Park Service seeks information on human-caused fires at F ...

April 15, 2024 | Seashore News

On Sunday morning, National Park Service law enforcement rangers responded to a report of two wildfires adjacent to Fort Raleigh National Historic Site’s Freedom Trail. Both fires were safely extinguished and posed no risk to public safety. Since the fires are suspected of being human caused, the National Park Service is asking the public for [...] Seashore News | Full ArticleSeasonal off-road vehicle (ORV) routes in front of Hatteras Island villages and the Ocracoke Campground become pedestrian-only starting on Monday, April 15. These routes, which run parallel to the towns of Hatteras, Frisco, Avon, and the Tri-villages, open to ORVs annually in the winter months when the visitor population is low, and close from April [...] Seashore News | Full ArticleCape Hatteras National Seashore will maintain gravel portion of Fl ...

April 12, 2024 | Seashore News

As a result of feedback received from the public during a two-week-long comment period, including residents that live on Flowers Ridge Road in Buxton, Cape Hatteras National Seashore (Seashore) has decided not to pave the 400-foot-long section of the road that leads into the private neighborhood. The Seashore requested funding for the road paving project [...] Seashore News | Full ArticleScaffolding around Cape Hatteras Lighthouse is 95% complete; Tempo ...

April 11, 2024 | Seashore News | By: Joy Crist

Despite multiple storms over the past few weeks, there have been waves of progress on the Cape Hatteras Lighthouse restoration project, starting with the tower of scaffolding. “We are closing in on 95% complete, so we expect to be done with the outside [scaffolding] by the end of April,” said Ed Milch, General Superintendent for [...] Seashore News | Full ArticleThe National Park Service’s Frisco campground reopened for the 2024 season on Saturday, March 30, per an update from the Cape Hatteras National Seashore (CHNS). Hatteras Island’s other seasonal CHNS campground, the Cape Point Campground in Buxton, remains temporarily closed due to flooding of low-lying campsites from the recent heavy rains. The Frisco and Cape [...] Seashore News | Full ArticleThe Cape Hatteras National Seashore (Seashore) invites public review and comments on a proposed project to pave a small section of road at the intersection of Lighthouse Road and Flowers Ridge Road in Buxton. Public comments will be accepted from March 28 through April 10, 2024. The current roadbed at the Seashore’s boundary is gravel [...] Seashore News | Full ArticleREMINDER: Cape Hatteras National Seashore will host public meeting ...

March 27, 2024 | Seashore News

On Wednesday, March 27, from 6-7 p.m., the public is invited to receive updates on the status of petroleum contamination and hazardous infrastructure remediation at Cape Hatteras National Seashore’s (CHNS) Buxton Beach Access. The public meeting will occur at the Fessenden Center, which is located at 46830 N.C. Highway 12 in Buxton, North Carolina. Following [...] Seashore News | Full ArticleNational Seashore temporarily expands beach closure at Buxton Beac ...

March 24, 2024 | Seashore News

Cape Hatteras National Seashore (Seashore) personnel expanded the size of a previously closed beach area in Buxton on Sunday afternoon, March 24. The expansion closes the Buxton Beach Access, located at the end of Old Lighthouse Road, and an additional stretch of beach, due to reports of petroleum odors and sheen on the ocean water. [...] Seashore News | Full ArticleTopDare County has released a new video highlighting the Dare County Recreation Map, a unique interactive resource that allows users to locate a variety of different attractions and amenities throughout Dare County—including area beach accesses, boat launches, dog parks, picnic areas, fishing piers, ball fields, walking trails and so much more. “We created the Recreation Map that’s part of the GIS system as a way to inform residents and visitors alike what there is to do in Dare County and ways to have fun,” said Dare County GIS analyst Kristen Stilson. “It’s a way to find fun no matter what your interests are. If it’s a rainy day, you can find things like museums to go see, or if it’s a sunny day and you want to get outdoors, you can find walking trails or ways to go crabbing on a dock.” Click here to access Dare County’s Recreation Map, and to view the video on Dare C [...] Island Features | Full Article

Tri Villages Market returns for 2024 on Memorial Day Weekend

April 15, 2024 | Island Features | By: Joy Crist

Hatteras and Ocracoke Islands’ newest weekly summertime market, the Tri-Villages Market, is returning in 2024 after a successful first season that exceeded all expectations. Though the northern Hatteras Island communities of Rodanthe, Waves, and Salvo had a seasonal market years ago, the Tri-Villages Market was a recent first for the area, attracting dozens of local [...] Island Features | Full ArticleIsland History: A spotlight on stories from the Outer Banks’ Lif ...

April 11, 2024 | Island Features | By: Jen Carlson

The Chicamacomico Life-Saving Station (CLSS) is celebrating its 150th anniversary this year, as one of the seven original Life-Saving Stations to be built in North Carolina in 1874. As such, the Chicamacomico Life-Saving Station and Historic Site in Rodanthe will be sharing stories about the seven 1874 Outer Banks stations in the months ahead, leading [...] Island Features | Full ArticleOcracoke festival aims to keep alive carving traditions

April 10, 2024 | Island Features | By: Jennifer Allen

From CoastalReview.org Living on the Outer Banks “requires you to be very much in touch with weather and Mother Nature,” says commercial fisherman Vince O’Neal. The lifelong Ocracoke resident and owner of the Pony Island Restaurant told Coastal Review recently that his family has been on the barrier island, which is only accessible by boat [...] Island Features | Full ArticleCoastal Studies Institute will host Open House on the ECU Outer Ba ...

April 10, 2024 | Island Features

The Coastal Studies Institute (CSI) and ECU Integrated Coastal Programs (ECU ICP) are hosting and Open House from 11 am.-3 p.m. on Saturday, April 20, 2024. The public is welcome and encouraged to attend this free event. Attendees will be able to tour the campus, grounds, and facilities, learn about current research and education programs, [...] Island Features | Full ArticleBarrier Island Group (B.I.G.) is pleased to announce its first Hatteras Island event – “4 for the 4th” – a four-mile run/walk to kick off the Fourth of July weekend. Originally scheduled for the morning of July 4, the race has been moved to July 3 in order to lessen the Independence Day burden on Dare [...] Island Features | Full ArticleCHSS Theater Program gets ready to launch its biggest production y ...

April 8, 2024 | Island Features | By: Joy Crist

Since December 2023, the talented students at Cape Hatteras Secondary School (CHSS) have been working hard to launch one of their most ambitious theater productions yet. The upcoming production of “The Little Mermaid,” which is hitting the stage April 19-21, has a crew of approximately 100 students and volunteers working behind the scenes, perfecting every [...] Island Features | Full ArticleDare Housing Task Force wants to incorporate more community voices in the process

April 18, 2024 | Real Estate | By: Mark Jurkowitz

From OuterBanksVoice.com Meeting one week after the county commissioners voted to cut ties with its remaining affordable housing partner and return $35 million in housing funds to the state, the Dare County Housing Task Force made several decisions on how to move forward—including one that involves broadening and restructuring the group. Following the suggestion of County Manager Bobby Outten that “maybe it’s time to make [the Task Force] a more community-led group,” members agreed to return next month with ideas about expanding it to bring in more grassroots voices and constituencies. Following feedback from Task Force members at the April 16 meeting, Outten acknowledged that currently, the county doesn’t really have its pulse on community sentiment on affordable housing. “Because we don’t have all the solutions, we’re [focused] on cookie-cutter solutions. And cookie-cu [...] Real Estate | Full Article

Coastal property owners yet to embrace roof-girding grants

April 16, 2024 | Real Estate | By: Catherine Kozak

From CoastalReview.org Maybe one North Carolina insurance provider should join the industry trend and advertise: “Hello Beach Plan policyholders! Do you need a new roof? Want to save on your property insurance? How about we help you out with as much as $8,000 toward a much stronger roof that is fortified to withstand storms? And [...] Real Estate | Full ArticleNorth Carolina Insurance companies have filed a request with the N.C. Department of Insurance to increase insurance rates for mobile home policies. The North Carolina Rate Bureau, which represents insurance companies and is not a part of the Department of Insurance, has requested an overall state average increase of 82.9% for mobile home fire policies [...] Real Estate | Full ArticleAnti-regulation sentiment may be fueling insurance crisis

April 8, 2024 | Real Estate | By: Catherine Kozak

First of a two-part series by Catherine Kozak, Coastal Review When Insurance Commissioner Mike Causey met last month in Manteo for a brief overview and Q&A with community members worried about property insurance issues, he stressed that his office had limited power over building code changes and insurance company business decisions in North Carolina that [...] Real Estate | Full ArticleState offering free flood insurance online conferences this year

March 28, 2024 | Real Estate | By: Sam Walker

From SamalkerOBXNews.com Five online conferences will be held between April and October to provide vital information regarding the need for flood insurance in North Carolina. The 2024 conferences will be similar to the ones offered in 2022 through WebEx, and will be free of charge to the public, insurance agents, adjusters, real estate agents, engineers, [...] Real Estate | Full ArticleIsland Real Estate: Hatteras Island home sales and trends for March

March 12, 2024 | Real Estate | By: Stephen Smith

Real Estate Market Update – March 2024 My main takeaway from the latest Outer Banks Association of Realtors (OBAR) monthly statistical report was land – vacant lot inventory is down even further than it was last year. Residential home inventory is improving (thank goodness) but land inventory is trending the opposite way. I touched on [...] Real Estate | Full ArticleHumpback whale that stranded on Pea Island found entangled in fishing gear

April 18, 2024 | Fishing | By: Joy Crist

A humpback whale was reported to partners in the NOAA Fisheries stranding network on the evening of Saturday, April 13, about 150 yards off the shoreline of Rodanthe. The next morning on Sunday, April 14, a local fisherman saw and reported the whale still alive and entangled in fishing gear off the coast of Rodanthe. On Tuesday, April 16, the whale washed ashore and stranded on the shoreline of Pea Island with gear entangled around a pectoral fin, and gear found in its mouth. The whale did not survive, and was reported to be a juvenile female that was 31.5 feet long. Due to the presence of fishing gear, NOAA’s Office of Law Enforcement is investigating the incident. According to NOAA Fisheries Communications Specialist Allison Garrett, there is an ongoing Unusual Mortality Event for humpback whales in the Atlantic. This is the 220th case along the East Coast and the 30th case off [...] Fishing | Full Article

Pea Island National Wildlife Refuge to host Earth Day Beach Clean- ...

April 18, 2024 | Community News Brief | By: Joy Crist

The Pea Island National Wildlife Refuge will host a public beach clean-up to coincide with Earth Day on Sunday, April 21, at 10 a.m. The event is open to anyone who wants to help, and folks can meet at Pea Island National Wildlife Refuge Visitors’ Center north of Rodanthe at 14500 N.C. Highway 12, beginning [...] Community News Brief | Full ArticleMeet the Outer Banks SPCA pet of the week, courtesy of their latest video produced by Dare County’s CURRENT TV. For more information on this pet, and the many other Outer Banks pets currently up for adoption, visit the Outer Banks SPCA website at https://www.obxspca.org/, or their Facebook page at https://www.facebook.com/obxspca/NAMI OBX Established to Support Mental Health in the Outer Banks

April 17, 2024 | Community News Brief

NAMI OBX, an affiliate of the National Alliance on Mental Illness (NAMI) announces the formation of an Outer Banks chapter to provide additional support mental health programs for adults and adolescents living with mental health issues in our communities from Corolla to Ocracoke. This chapter was made possible by community members who have been affected [...] Community News Brief | Full ArticleHatteras Island Community Strings will host a Spring Recital on Ap ...

April 16, 2024 | Community News Brief | By: Joy Crist

Hatteras Island Community Strings will host a Spring Recital on Tuesday, April 16, at 5:30 p.m., and the public is welcome to attend this free event at the Avon Volunteer Fire Department on Harbor Road. The recital will feature the students who are receiving free music lessons at St. John United Methodist Church (UMC) with [...] Community News Brief | Full ArticleMeet the Outer Banks SPCA pet of the week, courtesy of their latest video produced by Dare County’s CURRENT TV. For more information on this pet, and the many other Outer Banks pets currently up for adoption, visit the Outer Banks SPCA website at https://www.obxspca.org/, or their Facebook page at https://www.facebook.com/obxspca/Meet the Outer Banks SPCA pet of the week, courtesy of their latest video produced by Dare County’s CURRENT TV. For more information on this pet, and the many other Outer Banks pets currently up for adoption, visit the Outer Banks SPCA website at https://www.obxspca.org/, or their Facebook page at https://www.facebook.com/obxspca/April 9, 1951 – April 10, 2024 MANTEO — Charles “Chuck” Tomkinson III, age 73, of Manteo, NC, passed away on April 10, 2024. He was born on April 9, 1951, in Richmond, VA. Chuck led a fulfilling life centered around his passion for working with his hands and helping others in any way he [...] Obituaries | Full ArticleApril 10, 1948 – April 14, 2024 WAVES — Ronald H. Williams was born on April 10, 1948, in Manteo, NC, and peacefully passed away on April 14, 2024, at the age of 76 in Waves, NC. A man of few words, Ronald had the biggest impact on the lives of those around him. Retired [...] Obituaries | Full ArticleSeptember 11, 1935 – April 14, 2024 KITTY HAWK — Ann Weathersbee Davenport, of Kitty Hawk, NC, passed away peacefully on April 14, 2024, at the age of 88. Born on September 11, 1935, in Tarboro, NC, Ann lived a life dedicated to education and service. Dedicating over 30 years of her life as a [...] Obituaries | Full ArticleMarch 19, 1938 – April 11, 2024 MANTEO — John Bowen (Bo) Ross, Jr. passed away Thursday, April 11, 2024 on Roanoke Island, North Carolina. Bo was born to Margaret (Mot) Ellison Ross and John Bowen Ross on March 19, 1938 in Raleigh, NC. Bo spent most of his life in NC, living in Raleigh, [...] Obituaries | Full ArticleNovember 14, 1943 – April 8, 2024 BUXTON — Vivian Robinson Gray peacefully passed away in the early morning hours of April 8, 2024, at her home in Buxton, NC, with her husband, Charles, by her side. Vivian was a native daughter of Hatteras Island. She was born on November 14, 1943, to Vivian Eliza [...] Obituaries | Full ArticleO.R. “Bubba” Walke passed away peacefully on April 8, 2024, after a short illness, surrounded by his loved ones. Bubba lived a life full of compassion, kindness and unwavering love and dedication to his family and friends. His infectious smile, gentle spirit, easygoing and charismatic personality made him loved and respected by all who knew [...] Obituaries | Full Article

Hatteras and Ocracoke Islands’ Most Trusted News Source

(c) 2024 Island Free Press | Hyperlocal News Platform by MSP Media

Shopping Cart