The Ocracoke Occupancy Tax board will entertain new, modified or additional grant proposals for essential needs focusing on infrastructure.

The board made the announcement after meeting via Zoom on Thursday morning.

The board has not yet made decisions on grant requests submitted for the 2020-2021 fiscal year. These are typically discussed and at a public meeting and later decided on, but the board canceled the April 2 community meeting following Gov. Roy Cooper’s state of emergency declaration and Stay At Home order in response to the COVID-19 pandemic.

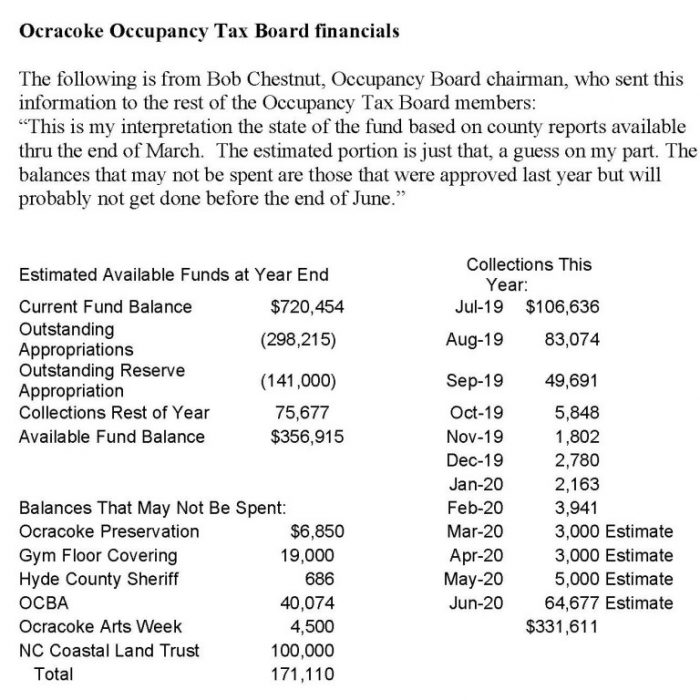

At Thursday’s virtual meeting, to which the Ocracoke Observer and the Ocracoke Current also joined, Bob Chestnut, board chair, noted that some projects approved last year might not be done this year because of delays in rebuilding from Hurricane Dorian and then the COVID-19 pandemic struck.

“About $171,000 won’t be spent this year,” Chestnut said.

So, the group decided to open the grant process back up so that island nonprofits who’ve already submitted can amend their proposals, either changing them or adding to them.

Chestnut said groups that have already submitted an application and want to change it don’t have to resubmit an entire grant but only the part they want to change.

Nonprofits who have not submitted a grant may also do so now.

Non-profits should submit any changes or new requests by 5 p.m. on May 15.

Requests can be mailed to Bob Chestnut, PO Box 517, Ocracoke, NC 27960 or dropped off at Ride The Wind Surf Shop.

Questions can be directed to Chestnut at 252-921-0231 or by email at bob@surfocracoke.com.

In addition to Chestnut, members of the Occupancy Tax board are Trudy Austin, Ann Warner, Byron Miller and Nancy Leach.

Application requirements are as follows:

- A single-page summary of the project identifying the use of funds and amount requested.

- Completed checklist of requested information.

- Detailed estimate as to the “use of funds” with a description/itemization of how the funds will be used (specific project) and estimated “line item costs.” All advertising and promotional costs should be listed as a separate line item.

- Timeline as to when funds will be needed (from July 1 to June 30; this is the Occupancy Tax budget year).

- Current (no older than 90 days) balance sheet of the organization that reflects the cash and investment position of the organization to include all assets and liabilities.

- Prior year’s profit and loss statement or cash flow statement (funds in and cash out) that reflects the use of any Occupancy Tax funds (description of use and amount).

- Budget (profit and loss or cash flow statement) for the year the Occupancy Tax funds are requested to include an explanation (identify by line item) as to the amount of the Occupancy Tax funds requested. The grant request amount should be identified so as to be considered along with other budgeted items of the organization.

- Such other information that the requesting organization feels would benefit the Occupancy Tax Board relative to the request (matching funds issues, etc.).

Occupancy Tax Funding Request Checklist

Please provide the completed checklist with your submitted request.

- Single Page Summary of Request

- Name and contact information (Name, phone, email) for organization submitting request.

- Detailed description/itemization of how requested funds will be used. Promotional and advertising costs identified separately.

- Project timeline showing when funds will be needed and when the project will be completed.

- Current balance sheet of organization

- Current profit & loss statement of organization

- Budget for the organization for July 1, 2020, to June 30, 2021, that includes funds requested from occupancy tax.