A settlement between homeowners insurance companies and state regulators has been reached that will lead to policies costing more across northeastern North Carolina and the Outer Banks over the next two years.

And the North Carolina Rate Bureau, which represents companies writing policies in the state, will not be allowed to request an additional increase until June 2027.

State Insurance Commissioner Mike Causey touted that he was able to prevent rate hikes requested by the Rate Bureau from topping 45% along the Outer Banks, and an almost 34% increase on the mainland.

“I fought for consumers and knocked them back to 7.5% increases (average statewide) over two years with a maximum of 35% in any territory,” Causey said. “We consider this settlement a big win for both homeowners and North Carolina.”

“This settlement will help insurers in North Carolina continue to provide customers with the peace of mind at the core of every homeowner’s policy: that when disaster strikes, your carrier will be there to help,” said N.C. Rate Bureau Chief Operating Officer Jarred Chappell.

But the settlement is not receiving positive reviews from the industry and the local area.

“The current base rates for homeowners’ insurance in coastal areas are already substantially higher than other areas of North Carolina, so even an increase of 5.1% is significant to policyholders in Dare and Currituck counties,” said Outer Banks Association of Realtors Government Affairs Director Donna Creef.

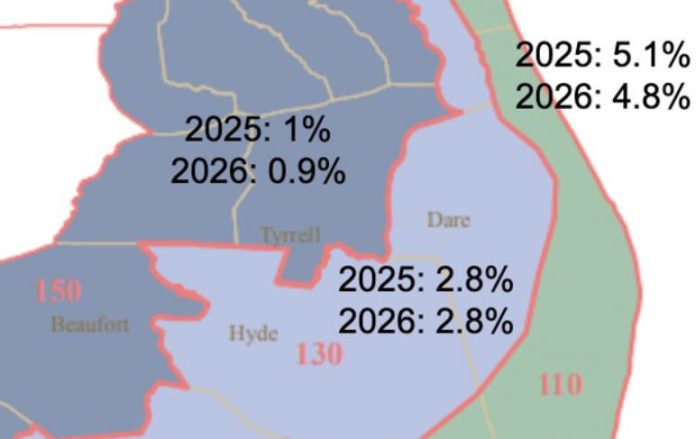

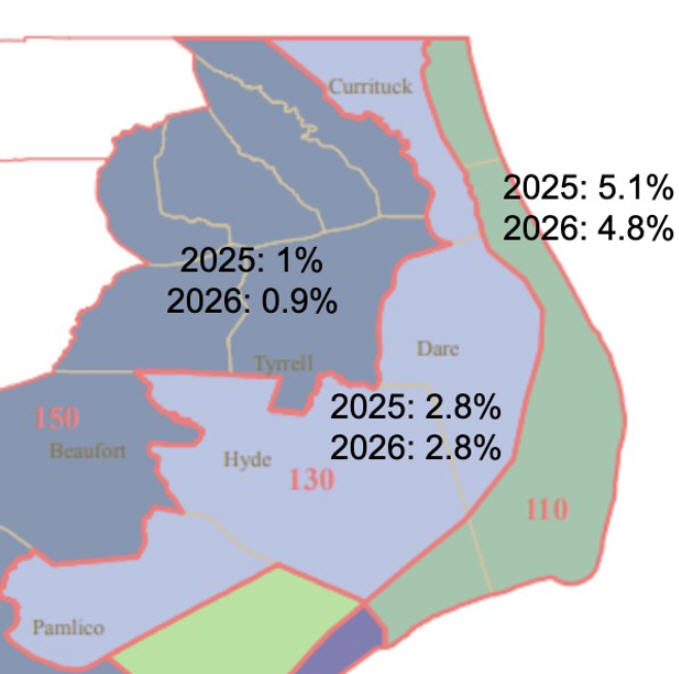

New and renewing homeowners policies from Carova to Ocracoke, known as Territory 110, will increase by 5.1% starting on June 1, 2025, and then 4.8% in June 2026.

In Territory 130, which covers mainland Currituck, Dare and Hyde counties, rates will go up by 2.8% each year.

Camden, Chowan, Pasquotank, Perquimans, Tyrrell and Washington counties, where the Rate Bureau wanted to see a hike of 25.6%, will instead only go up by 1% this year and 0.9% in 2026.

Along the central and southeastern beach areas of the state from Atlantic Beach to the South Carolina border the companies wanted an increase of 99.4%, but instead get increase of 16% in 2025 and 15.9% next year.

“These rates are sufficient to make sure that insurance companies, who have paid out large sums due to natural disasters and face increasing reinsurance costs due to national catastrophes, have adequate funds on hand to pay claims,” Causey said in a statement.

Chappell disagreed with Causey saying it was an adequate settlement, but called it “a step in the right direction, and this industry always looks to work with regulators toward solutions.”

Creef said Causey did not follow through with the review process of the request.

“The rates requested by the NC Rate Bureau filed in January 2024 were excessive, and I believe that would have been the conclusion of the hearing process if the hearing proceedings had continued,” Creef said.

The settlement announced Friday came after the first hearing on any rate request since the Republican first took office in 2017 began last fall.

Critics said he gave “sweetheart deals” to the companies previously by not forcing them to justify their requests.

Causey countered that his predecessors were also inclined to settle requests.

“During the past 20 years, there have been eight dwelling and fire rate filings. Only one went to a hearing,” Causey said last fall. “Settling and not going to court saves consumers and taxpayers money. Hearings are the exception when negotiations fail.”

The request filed by the N.C. Rate Bureau on homeowners insurance policies was the first since a 2021 settlement with the state’s Department of Insurance which raised rates across northeast N.C. of 9.9% and blocked any new rate change proposals until 2024.

Owners of rental properties were hit with increases to their dwelling policies last year following a settlement.

Well over 100 people from across North Carolina took part in a public comment session on the homeowners rate request held last January.

Residents of northeastern North Carolina and the Outer Banks, who participated both in-person and online, pointed out that the coastal sections of the state were being unfairly targeted once again.

Among them were Outer Banks Association of Realtors CEO Willo Kelly and Creef, who have been at the forefront of battling the inequities in insurance rates our area has faced when compared to areas well inland.

“The rating process is disingenuous, with the Rate Bureau filing excessive rate increases, NCDOI negotiating lower increases, and then the settled rate increases being announced as a positive outcome for policyholders,” Creef said.

WRAL-TV reported an attorney for the Rate Bureau said at the October hearing the highest inflation in 40 years — particularly on building materials — combined with calamitous storms that are “getting worse and worse” show that current premium rates are “severely inadequate.”

Causey has also been criticized for supporting legislation passed by the N.C. General Assembly that revamped “consent-to-rate” in 2019, which is an agreement between the customers and insurance companies that allow a higher rate to be charged.

That has been responsible for recent spikes in rates for some customers along the coast that went above and beyond the base rates negotiated between the Department of Insurance and the Rate Bureau.

Some experts have said consent-to-rate is the only way many insurance companies can continue to do business in North Carolina.

The Insurance Department’s attorney argued at last fall’s hearing that the industry continued to use actuarial methods that ignore what state law requires in calculating rate increases, and the bureau’s requested rates were inflated and that the department had data to recommend a decrease.

Causey did not hear the case in part because he’s not an attorney he said during a news conference in October. State law allows him to pick someone else to preside over the hearing, which is a quasi-judicial proceeding.

And he said that his Democratic predecessors, Jim Long and Wayne Goodwin, did the same.

The insurance commissioner has tried to tamp down some of his critics on the coast, holding a forum in Manteo last March where he stressed that his office had limited power over building code changes and insurance company business decisions in North Carolina that unnerved homeowners, Coastal Review reported.

A news conference was scheduled for Friday afternoon at the department’s office in Archdale.

But only a roughly five minute long statement from the commissioner was posted on the NCDOI Facebook page, and there appeared to be no one in attendance to ask questions.