Legislative update: Sales tax redistribution is back, will still hurt Dare

General Assembly members worked at break-neck speed last week. Substantial additions were made to some bills, language was stripped out and new topics added into others, and a bill about local government reform became an elections bill.

But the bill that gained the most attention was one that had been dormant for months but now appears to have gotten a new life after being added into another bill, House Bill 117, the “N.C. Competes Act.”

Before last week’s changes, HB 117’s focus was a proposed economic incentives package voted out of the House. But last week, in the Senate Finance Committee, major portions of a sales tax redistribution bill – Senate Bill 369 – were added to the legislation, while incentives were pared back.

No vote was taken on the substantially altered HB 117, nor was there any indication about its future. The Senate committee could approve the changes and move it along in the legislative process or some lawmakers predict that it will be tucked into the Senate version of the budget.

The latter, say legislators, would put pressure on members to approve it because to vote against it would mean voting against the budget.

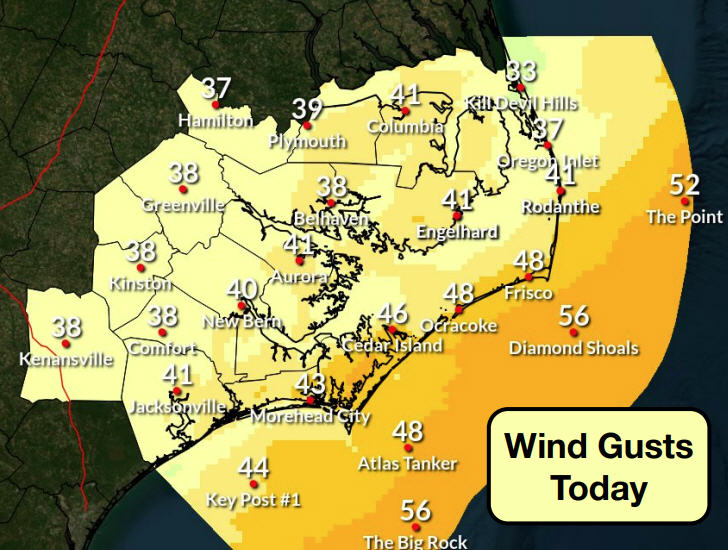

The legislation proposes to shift the sales tax distribution over a period of four years to 80 percent based on population and 20 percent on point-of-sale over a period of four years. Proponents of the bill say that the redistribution will help poor, rural counties by redistributing the wealth brought in by the more prosperous urban counties.

The switch will be especially painful for Dare County with its relatively small year-round population, compared to its very high population in the tourist season.

Because of its high summer visitor population, Dare’s sales tax revenues, based on the current 75 percent on point-of-sale, are among the highest in the state. However, its permanent population is estimated to be only about 35,000, so it stands to lose more revenues than any county in the state.

Financial impact charts presented to the Senate Finance Committee estimate that after the end of four years when the program is fully implemented, Dare County would lose just 7 percent of the estimated $20 million that it now collects. That equates to a $1.4 million loss. According to the same set of committee charts, local municipalities would lose 44 to 46 percent of the sales tax revenues they now collect.

But those figures aren’t correct, according to Dare County Finance Director Dave Clawson. The Senate projections are based on passage of an optional half-cent sales tax that could be implemented with a local referendum and increased sales tax revenues. The increased tax revenues would be achieved by expanding the sales tax base by adding tax on maintenance and repair of tangible personal property, such as vehicles, and to veterinary and pet services.

According to Clawson, county property tax increases to replace the funds that are used to support the county’s budget would range from a 1.77-cent increase the first year to more than 7 cents at the end of four years because of the loss of $9.3 million. Local towns would have to raise property taxes from 3 to 5.5 cents to make up for the loss.

Click here to see the Senate Finance Committee’s estimate of the impact of HB 117 on Dare County.

Click here to see Dare County Finance Director Dave Clawson’s estimate of the impace of HB 117 on the county and its municipalities.

In other legislative action last week, the House voted to override Gov. Pat McCrory’s veto of SB 2 which will now allow magistrates and register of deeds employees to avoid issuing marriage licenses and/or presiding over marriages of same-sex couples if doing so conflicted with their own religious beliefs. The Senate had already voted to override the veto.

The preceding week, the House and Senate voted to override the governor’s veto of a bill that makes whistle-blowing by some employees into a criminal offense.

SB 374, titled “Modify For-Hire License Logbook Requirement,” has passed the House Wildlife Resources Committee. The bill, if passed into law, would amend the requirement for holders of for-hire coastal recreational fishing licenses to keep logbooks detailing catch and effort. Instead of mandatory, keeping and reporting the data would be voluntary.

If made into law, the bill also would stop the authorization of a Joint Enforcement Agreement between the N.C. Marine Patrol law enforcement and the National Marine Fisheries Service enforcement which would allow joint enforcement in state waters.

SB 25 is now awaiting the governor’s signature to become law. Titled the “Zoning/Design and Aesthetic Controls,” the bill takes away local authority to mandate design standards and to implement rules to protect adjoining property owners, such as controlling fill that could cause surrounding properties to flood.

HB 836 initially was the Local Government Regulatory Reform bill but was renamed Election Modifications last week when much of the language was stripped out of the bill and replaced with election issues related to use of technology.

(Sandy Semans is a retired newspaper editor and reporter who now works as a free-lance writer. She lives in Stumpy Point. Her update on the goings-on in this session of the General Assembly will appear weekly in The Island Free Press, usually on Friday.)

PREVIOUSLY PUBLISHED 2015 LEGISLATIVE UPDATES

First bill filed would prohibit condemning property for economic development

Legislative Update: And they are off — sort of

Legislative Update: The gold rush in Raleigh is underway

Legislative Update Most Bills Moving At Snails Pace But One Achieves Warp Speed

Legislative Update: Humor unleashed in the General Assembly

Legislative Update: Lawmakers made hay while the sun was shining

Legislative Update: Bill on dredging causes local turmoil

Legislative Update: 156 new bills filed this week

Legislative Update: Lawmakers keeping busy in Raleigh

Legislative Update: It was raining bills all week

Legislative Update: Bill on dredging causes local turmoil

Legislative Update: Occupancy tax provision is out of dredging bill

Legislative Update: Lawmakers take aim at N.C. Constitution

Legislative Update: More taxes and Constitutional amendments proposed

Legislative Update: Lawmakers racing the clock to get bills moved

Legislative Update: Rushing to meet the ‘crossover’ deadline

Legislative Update: A week of committee work in Raleigh

Legislative update: New taxes for fishermen and new purpose for occupancy taxes

Legislative Update: Bill aims at opportunities for Oregon Inlet Lifesaving Station

Legislative Update: Two days, two vetoes

Legislative Update: Sales tax redistribution bill gets more traction