Next spring when a single mother in Newton takes her old car to the Jiffy Lube for an oil change, she will be in for quite a surprise. It is going to cost her 6.75 percent more, thanks to the budget passed by the House and Senate and signed by Gov. Pat McCrory that for the first time imposes a sales tax on car repairs and services.

If she returns home to find that her washing machine isn’t working, it’s going to cost her more to have it fixed. The budget applies the sales tax to appliance repairs too.

If she somehow scrapes the money together to buy a new washer instead, she better pick it up herself as it will cost her more to have it delivered. The budget adds the sales tax to deliveries.

And she may also be surprised to learn that none of the extra money she will have to pay to fix her car or washing machine will stay in her county to help her daughter’s school or improve the local roads.

Instead it will go to another county in the state as part of a scheme inserted into the final budget agreement that expands the sales tax to a host of commonly used services with the proceeds directed to a special fund that benefits 79 counties, while 21 mostly urban and tourist counties receive nothing.

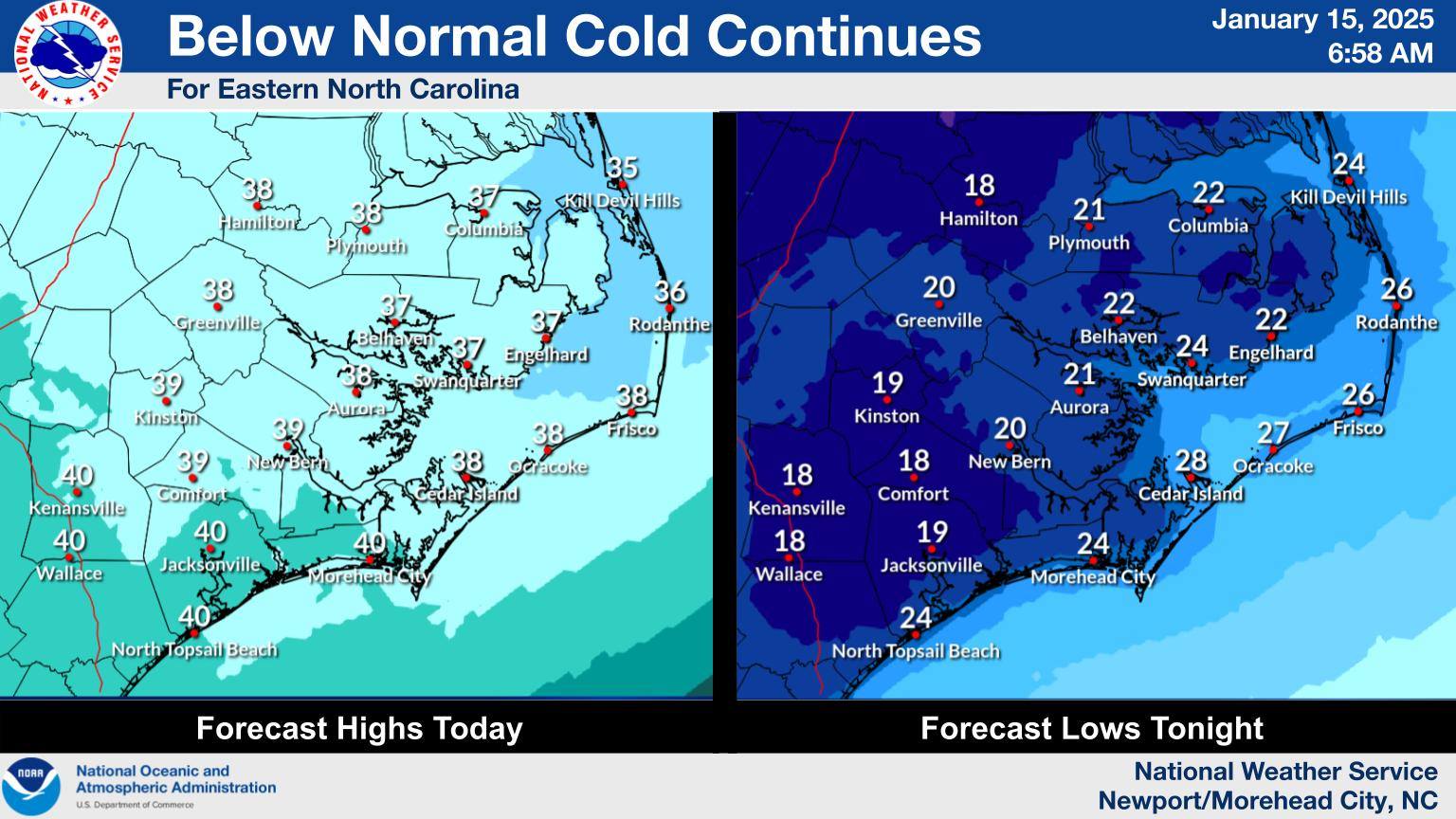

So not only will folks in Newton in Catawba County pay higher taxes and see none of the benefits, so will folks in places like Brunswick County and Cabarrus County and Dare County, as well as Durham and Winston-Salem and Charlotte.

Everyone in the state will pay more the next time they have their shoes resoled or their flat tire fixed. And the majority of the people who pay the extra tax will not see it go to improve their local communities.

Earlier this month, Gov. Pat McCrory said of the expansion of the sales tax to services, “A tax increase on small business is not good for the hard-working men and women of the state,” and he sharply criticized lawmakers for inserting the scheme into the final budget agreement.

The comments prompted speculation that McCrory might veto the budget, but he signed it last Friday, apparently no longer troubled by raising taxes on low-income families.

Supporters of the new sales tax plan claim that it is not a tax increase, that it will be offset by a reduction in the personal income tax rate. But that’s not true for the folks at the bottom of the economic ladder who will receive very little, if anything, from the income tax cut.

Millionaires by the way will receive a $2,000 break and that’s on top of the windfall they received in the 2013 tax cut package.

Low income folks won’t be so lucky.

You might be wondering how this regressive tax scheme passed the General Assembly and what people said it about it as it made its way through the legislative process.

It never went through any committee. It appeared out of nowhere in the final budget agreement and questions about the formula and how to distribute the money in future years were not answered .

Proposals to restore the state Earned Income Tax Credit to help low-wage workers and their families that could offset a sales tax hike have also been repeatedly ignored.

There are plenty of reasons why the budget passed by House and Senate leaders last week takes North Carolina in the wrong direction.

One big one is that it raises taxes on people who can least afford to pay more. McCrory was right the first time.

Too bad he didn’t stick to his guns and veto the budget and prevent that single mother and thousands of other struggling families from paying more to keep their cars on the road and their washing machines working. Too bad he didn’t stand up for them instead of the millionaires.

(Chris Fitzsimon is the Executive Director at N.C. Policy Watch. NC Policy Watch is a progressive, nonprofit and non-partisan public policy organization and news outlet dedicated to informing elected officials as they debate important issues and, ultimately, to improving the quality of life for all North Carolinians. Read more commentary at www.ncpolicywatch.com.)