Local leaders hammer away at sales tax plan

At a news conference on Monday, Dare County leaders continued their assault on the North Carolina Senate’s plan to change the way sales tax is redistributed to the state’s counties.

The plan, originally introduced as a bill last winter, lingered in a committee for months and then suddenly found its way into the Senate’s budget for the next fiscal year. Local leaders say the plan would be “devastating” for Dare County.

Under the plan, revenue from a 2 percent local option sales tax would be shifted from larger, wealthier counties to poorer urban areas. Senate Majority Leader Harry Brown, who introduced the legislation, said the redistribution is the fairest and most equitable way to help smaller counties that struggle to fund infrastructure and schools.

The redistribution plan would flip the formula for sharing the local option tax — from 75 percent based on point of sale and 25 percent on population to 80 percent on population and 20 percent on point of sale.

The plan, which would be phased in over four years, would help the smaller counties whose residents travel to metropolitan areas to shop and work. Brown says it will increase revenue to 83 counties and reduce funds that flow to 17 others.

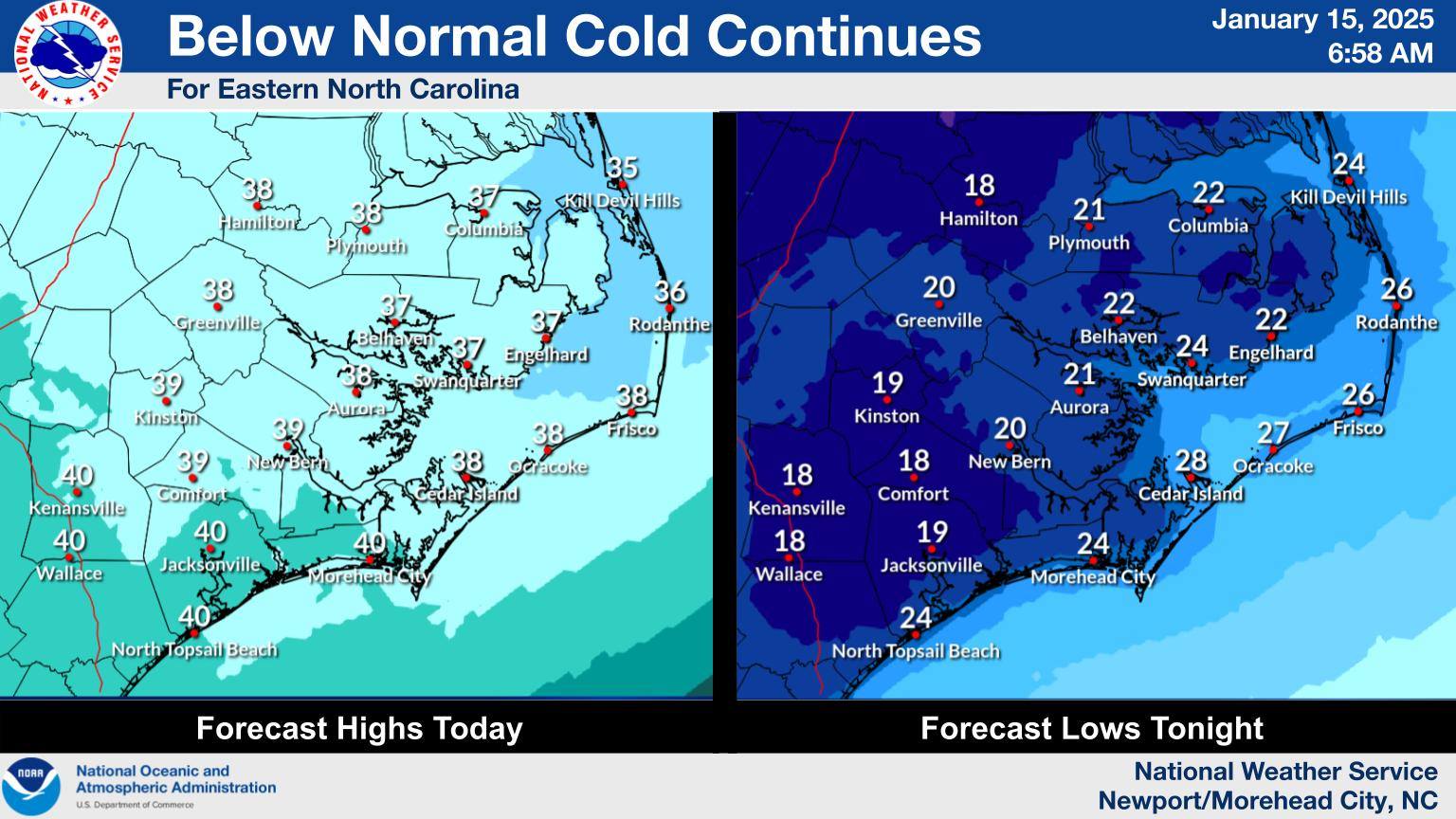

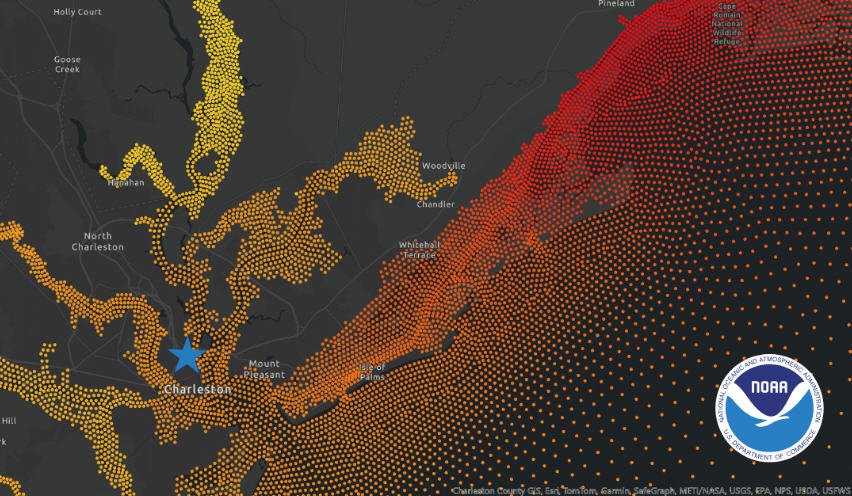

However, the plan would take millions from Dare County and its cities — and several other counties with thriving tourist industries. These counties have small populations, but are not major hubs for commerce. Instead, they draw large sales tax revenues from tourists.

Instead of keeping 75 percent of the sales tax dollars to provide services and infrastructure to an extra 300,000 residents each week in the summer, Dare, with a year-round population of only 35,000, would be sending 80 percent of the revenue to Raleigh.

To make up the lost revenue, local leaders say, Dare and its municipalities would have to cut services, raise property taxes, or do some of each.

Dare County stands to lose $9 million to $15 million, depending on which estimate is used, Dare County manager Bobby Outten said in a presentation that kicked off the news conference.

Outten says the county now returns 78 percent of the local option sales tax to Raleigh. That would grow to 94 percent under the Senate plan.

Outten also addressed public statements by Brown and others that Dare County, with the sixth lowest ad valorem tax in the state, can “afford” to raise taxes.

While the county’s property tax rate is only 43 cents per $100 of value, Dare also has some of the highest property values in the state, which makes it “low rate, high value” county, while others are “high rate, low value” counties.

He said Dare County property owners are paying at a much lower rate than homeowners in other counties, but they are often still paying more in ad valorem taxes.

Some examples that Outten has often used and presented again at the news conference:

An average 1,500 square-foot home in Dare County is valued at $239,000. At 43 cents per $100, the owner is paying $1,029 in ad valorem taxes.

An average 1,500 square-foot home in Nash County is valued at $100,500. At 67 cents per $100, the owner is paying $740 in ad valorem taxes.

An average 1,500 square-foot home in Richmond County is $79,230. At 81 cents per $100, the owner is paying $641.

Dare’s commissioners have been traveling to Raleigh at least once a week to make the county’s case to legislators.

At Monday’s news conference, the commissioners were joined by mayors of the county’s towns, a member of the Currituck County board, and representatives from the Outer Banks Chamber of Commerce and the Outer Banks Association of Realtors — all of whom oppose the plan.

Dare’s municipalities will also lose a percentage of the funding they now receive in sales taxes — making the consequences even more dire, leaders say, for the towns’ property owners.

Kill Devil Hills Mayor Sheila Davies said that over time, property owners in her town would have to pay 38 percent more in local and county property taxes to make up for the loss.

“We cannot shift that tax burden to our year-round, working-class population,” she said.

Instead, Davies said, the town will have to cut expenses. However, she added, the types of cuts that would have to be made would go beyond what some might call “tightening the belt.”

“You cannot overcome the millions of dollars in revenue losses generated by the tax redistribution by cutting office supplies, fuel and toilet paper,” she said.

Mayors of other towns echoed Davies’ comments.

Nags Head Mayor Bob Edwards said that by 2019, the plan would add $760 a year to the property tax bill on a $400,000 house. He said that the alternative, reducing costs, would mean cutting one third each from the police, fire and public works departments.

Town leaders in Duck, Kill Devil Hills and Kitty Hawk noted that property owners are already seeing tax increases to help pay for beach nourishment.

David Griggs, vice-chairman of the Currituck County Board of Commissioners, came to the news conference to say, “This is not just a Dare County problem.”

Currituck County, he said, would need at least a 4-cents per $100 property tax increase to make up for lost sales tax revenue, he said.

And Currituck faces the same issue of having to provide services to a burgeoning summer population. The county’s population of 24,000 grows to a million with summer visitors to the Currituck Outer Banks.

“Southern hospitality does not come cheap, especially on a barrier island,” he said.

Davies and others made the point that there are other ways of achieving the Senate’s goal of helping poorer counties.

“We should work collectively to raise new revenue to help struggling counties,” she said, adding that possibilities might include an increased tax on cigarettes or a tax on the new “e-cigarettes.”

Rep. Paul Tine, who represents Dare County, in the House, attended the news conference. The counties he represents are both winners and losers in the new plan.

However, he said, he opposes it. He called the plan a “money grab” for votes and warned that the fight will continue even if no action is taken during the current legislative session.

He, too, called for a different approach.

“The state should be the one sharing with poorer counties,” he said, adding that the funds could come from the state’s budget surplus or from the state’s 4.75 percent share of the current 6.75 percent sales tax. He said the state should be funding infrastructure, schools, and community colleges in poor counties.

“We should invest in rural communities, but we need to do it in the right way…You can’t kill Dare County to help Hyde and Washington counties,” he said.

The sales tax redistribution plan is not included in the House budget nor is it in the Governor’s budget.

Tine vowed to continue fighting to keep it out of the compromise budget that the two chambers are currently negotiating, but he noted the difficulty and danger of doing that when the two budgets are so very different and there are many small details to be ironed out.

Bob Woodard, chairman of the Dare County Board of Commissioners, said that Sen. Bill Cook had a scheduling conflict and couldn’t attend yesterday’s news conference.

Cook voted in favor of the Senate budget, saying that he opposed the sales tax plan but liked other items in the budget. He said he would work to get the sales tax plan out of the final, negotiated product.

However, it remains to be seen whether he can get that done or whether he will vote for or against the final budget if the sales tax redistribution is still included.

Gov. Pat McCrory has said he will veto the budget if the sales tax redistribution plan is not removed.

Click here to see a video of the entire news conference.

RELATED ARTICLE

Raleigh takes aim at Dare County