Insurance companies that cover rental and investment properties are asking state regulators for a significant increase in premiums for dwelling policies on the Outer Banks and in northeastern North Carolina spread over the next two years.

The North Carolina Department of Insurance received the dwelling insurance rate filing from the North Carolina Rate Bureau on August 18.

Dwelling insurance policies cover non-owner-occupied residences of no more than four units, including rental properties, investment properties and other properties that are not occupied full time by the property owner. Homeowner policies that cover primary residences are a separate category.

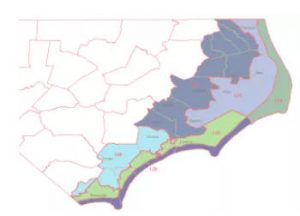

North Carolina’s coastal insurance territories were most recently updated in 2015. [NCDOI image]The N.C. Rate Bureau is made up of insurance industry representatives, researches and experts that provide the state insurance commissioner data that reflects rate increases or decreases needed by the industry.

The request asks for extended coverage, which includes wind and hail, to go up 33.0 percent for buildings and 21.8 percent for contents on April 1, 2023 and again on April 1, 2024.

On the Currituck, Dare and Hyde mainland areas, Territory 130, fire rates would increase 4.5 percent while contents covered by fire policies would decrease 5.1 percent in April 2023.

Extended coverage for Territory 130 would increase 23.3 percent for building and 12.9 percent for contents in April 2023 and April 2024.

Territory 150, which includes Camden, Pasquotank, Perquimans, Chowan, Tyrrell and Washington counties, fire policies would see hikes of 24.9 percent for buildings and 13.5 percent for contents. Extended coverage only goes up 5.8 percent for buildings, while contents drops 3.1 percent, in both years.

The rate filing follows the dwelling policy rate filing the Department of Insurance and Rate Bureau settled in March 2021 that had no increase in fire policies, and a 10 percent increase for buildings under extended coverage. It also had a 10 percent increase for extended coverage of contents in territories 110 and 130, and 2.9 percent in Territory 150.

Those wanting to comment on the rate request may do so in one of two ways:

- Emailed public comments should be sent by Sept. 19 to: NCDOI.2022DwellingandFire@ncdoi.gov.

- Written Public comments should be mailed to Abby Spann, Paralegal III, to be received by Sept. 19 and addressed to 1201 Mail Service Center, Raleigh, N.C. 27699-1201.

All public comments will be shared with the N.C. Rate Bureau. If Department of Insurance officials do not agree with the requested rates, they will be negotiated with the N.C. Rate Bureau. If a settlement cannot be reached within 50 days, a hearing will be called.