Legislative update: Sales tax plan proposal scaled back, but still alive

No direct budget talks are taking place yet in the General Assembly, but there are efforts to pave the way so that when negotiations do begin, there is less “clutter” on the road to a budget.

Anticipating the House’s resistance to a plan to redistribute sales tax that was inserted into the Senate version of the budget, this past week, the proposal was scaled back and added to House Bill 117, NC Competes, an economic development bill requested by Gov. Pat McCrory.

The new proposal is to split the distribution of the sales tax with half being based on point of sale and the other half based on population — instead of the original 80 percent based on population and 20 percent on point of sale. If made into law, the redistribution would go into effect in the fiscal year beginning July 1, 2016 and the full change would occur at that time instead of being phased in as in the previous plan.

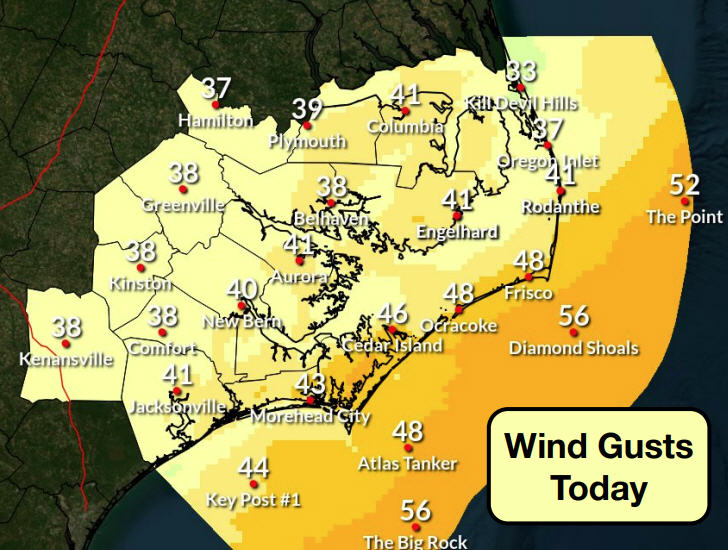

The 50-50 scenario would reduce sales tax coming back to Dare County and the local municipalities by 24 percent. Under current law, which dictates that 75 percent of the sales tax sent back to local governments is based on point-of-sale and 25 percent on population, Dare County is estimated to receive $19.1 million in the 2016-17 fiscal year. Under the new plan, the amount would be reduced to $14.6 million, which is a $4.6 million cut — unless the proposal to expand the sales tax base is approved.

An expansion of the sales tax base, adding tax on such things as auto repairs and veterinarian bills, would return some of the lost revenue to counties. With that expansion, estimated sales tax revenues would be $15.1 million which is a $4 million reduction – 21 percent – from projections for the same time frame under current law.

The municipalities also would feel the same percentage of reductions under both scenarios.

Currituck County, without the expansion, would lose 8 percent or $707,624; with expansion the percentage would drop to 4 percent and a $400,000 loss.

Neighboring low-wealth counties, Hyde and Tyrrell, would gain little from the new plan. Hyde County would net about $26,000 without expansion and an estimated $80,000 with an expanded sales tax base. Tyrrell would gain about $115,000 without an expanded sales tax base and $143,000 with the expanded base.

There had been little action since March on the proposed economic development legislation until this week when it was fast-tracked. A final Senate vote on the bill is expected to occur on Monday, Aug. 10. The bill then will go back to the House for concurrence. If that does not concur, it will then be sent to conference committee to hammer out changes acceptable to both chambers.

Earlier in the session, the sales tax redistribution language was added into HB 117 but was removed within hours with no explanation.

Gov. McCrory has said that he would veto sales tax redistribution, but since it is now tied in with his economic development request and reduced in impact, it is not clear what his intentions might be.

In addition to the governor’s favored economic development bill now gaining life, the House began moving forward with HB 943 – Connect NC Bond Act of 2015 – that was introduced on Aug. 3, and by Aug. 6 had cleared that chamber and was heading to the Senate.

The bill, if enacted, would allow a bond referendum to be placed on the 2016 Presidential Primary ballot to allow voters to decide if the state can obtain a bond loan of $2.8 billion to fund work on infrastructure and roads sought by the governor. McCrory has lobbied legislators and elected officials across the state to try to gain support for the bond measure.

Included in the list of projects to be funded with the bond money is $300 million for community colleges, almost a billion for repairs, renovations and construction of buildings on University of North Carolina campuses and $500 million to pay for new or renovated public school structures. The bulk of the remaining funds would be used for transportation-related projects.

During McCrory’s visit to Dare County about a month ago, money was proposed for the Graveyard of the Atlantic in his bond request but it is not included in the bill.

Thus far, the Senate has not offered an encouraging response to the legislation.

Several proposed amendments to the North Carolina Constitution were introduced early during this session but until this week, most have stayed dormant.

SB 607, dubbed Taxpayer Bill of Rights, seeks to add three amendments to the Constitution.

One amendment would mandate that the state income tax rate cannot exceed a maximum rate of 5 percent of net income after deductions. Currently, the maximum is 10 percent.

Another proposed amendment, if approved by voters, would create an emergency savings reserve of surplus revenues to be dipped into only in the case of revenue shortfalls. Transferring revenues from the fund into the state’s general fund would require a two-thirds approval in both chambers.

And the third proposed amendment would limit the growth of state spending to inflation growth plus population growth of the previous year. The increase may be exceeded with two-thirds approval in each chamber.

If approved by both chambers and signed by the governor, the proposed amendments would be added to the 2016 Presidential Primary ballot for voters to decide the fate of the proposals.

Opponents of HB 367, NC Consumer Fireworks Safety Act, say the name is a misnomer for the bill that seeks to allow the public broader access to fireworks. If enacted, the law would legalize the use and sale of airborne consumer fireworks in the state. Insurance Commissioner and State Fire Marshal Wayne Goodwin has been joined by a growing list of organizations opposing the bill. North Carolina State Firemen’s Association, North Carolina Association of Fire Chiefs, National Fire Protection Association, American Burn Association, North Carolina Emergency Nurses Association, North Carolina Fire and Life Safety Educators, North Carolina Jaycee Burn Center and Safe Kids North Carolina have each lobbied to get the bill killed.

SB 374, the Modify For-Hire License Logbook Requirement, has passed both chambers and been signed by the governor, thus is now law. The legislation, sponsored by Sen. Bill Cook, R-Chocowinity, repeals the for-hire coastal recreational fishing licenses logbook requirement and prohibits the N.C. Division of Marine Fisheries director from entering into a Joint Enforcement Agreement between the state’s Marine Patrol and the National Marine Fisheries Service.

(Sandy Semans is a retired newspaper editor and reporter who now works as a free-lance writer. She lives in Stumpy Point. Her update on the goings-on in this session of the General Assembly will appear weekly in The Island Free Press, usually on Friday.)

PREVIOUSLY PUBLISHED 2015 LEGISLATIVE UPDATES

First bill filed would prohibit condemning property for economic development

Legislative Update: And they are off — sort of

Legislative Update: The gold rush in Raleigh is underway

Legislative Update Most Bills Moving At Snails Pace But One Achieves Warp Speed

Legislative Update: Humor unleashed in the General Assembly

Legislative Update: Lawmakers made hay while the sun was shining

Legislative Update: Bill on dredging causes local turmoil

Legislative Update: 156 new bills filed this week

Legislative Update: Lawmakers keeping busy in Raleigh

Legislative Update: It was raining bills all week

Legislative Update: Bill on dredging causes local turmoil

Legislative Update: Occupancy tax provision is out of dredging bill

Legislative Update: Lawmakers take aim at N.C. Constitution

Legislative Update: More taxes and Constitutional amendments proposed

Legislative Update: Lawmakers racing the clock to get bills moved

Legislative Update: Rushing to meet the ‘crossover’ deadline

Legislative Update: A week of committee work in Raleigh

Legislative update: New taxes for fishermen and new purpose for occupancy taxes

Legislative Update: Bill aims at opportunities for Oregon Inlet Lifesaving Station

Legislative Update: Two days, two vetoes

Legislative Update: Sales tax redistribution bill gets more traction

Legislative update: Sales tax redistribution is back, will still hurt Dare

Legislative Update: Senate passes its version of state budget

Legislative Update: Budget conference committee faces challenges

Legislative Update: Hurry up and wait time in Raleigh

Legislative Update: Open government laws are a mixed bag

Legislative Update: Some bills moving forward, others stuck in committees

Legislative Update: House slows up, while Senate moves full steam ahead

Legislative Update: Work slows to a crawl as lawmakers travel