It’s official: County employees to receive raise

Dare County Board of Commissioners has approved the budget for the 2013-14 fiscal year, which begins July 1 and includes a 3.25-cent tax increase.

The revenue neutral rate determined after the revaluation totals were set was 39.75 cents per $100 dollars of property value. The revenue neutral rate is the rate that would generate the same amount of revenue used to support the previous fiscal year’s budget. Included in that rate is a growth factor based on a formula provided in the state statutes. The tax increase brings the rate up to 43 cents per $100.

The tax increase adds about $60 to the tax bill for a property valued at $200,000.

The budget was approved by a four-to-three vote with Commissioners Richard Johnson, Bob Woodard, and Jack Shea voting against it. All three of the Republicans objected to an increase in taxes and questioned giving a cost of living raise to the employees, who had not received a raise since 2008.

At the commission’s last meeting in May, Commissioner Richard Johnson questioned why so many nonprofits are receiving special appropriations. In particular, Johnson pointed to Food for Thought and noted that its last tax filing showed a fund balance of about $200,000.

That issue became moot in the June 3 meeting when Loismary Hoehne, president of the Food for Thought Board of Directors, told the board during the public comment section of the meeting that the agency has received a Walmart Foundation grant for $20,000 and therefore does not need the additional funding from the county. Hoehne said that recognizing that it is a difficult period for the county, the agency was withdrawing its request for the special appropriation. She noted, however, that it might come back to the board for help in the future.

Although the budget is now set, there could still be changes based on the approval of a state budget.

The salaries for a number of teaching positions are paid by Dare County. The budget adopted on Monday includes a one percent cost of living raise for them. However, Dare County Manager Bobby Outten said that could change.

“Different [proposed state] budgets have different amounts,” said Outten. The governor’s proposed state budget includes a one percent cost of living raise but the Senate budget version has none. The North Carolina House has not yet completed its proposed version. Dare County will give the county-paid teachers the same as that received by the state-paid teachers. If the adopted state budget contains no raise for teachers, then the county-budgeted money will be deducted.

County property taxes are applied county-wide, but property tax bills vary widely throughout both the unincorporated areas and in the municipalities as town tax rates, sanitation, and special tax district rates are added to the base rate.

The proposed base tax of 43 cents plus the 10.3 cents for sanitation will be throughout the unincorporated areas. In addition, those areas with special tax districts used to support community centers and fire departments will have additional taxes. Boards of Trustees set the budgets and submit requested tax rates for the community centers, and fire department boards of directors submit budgets and corresponding tax rates for consideration. Before submitting the budget and tax requests, all rates are reset to revenue neutral, although they can be added to or decreased with county approval.

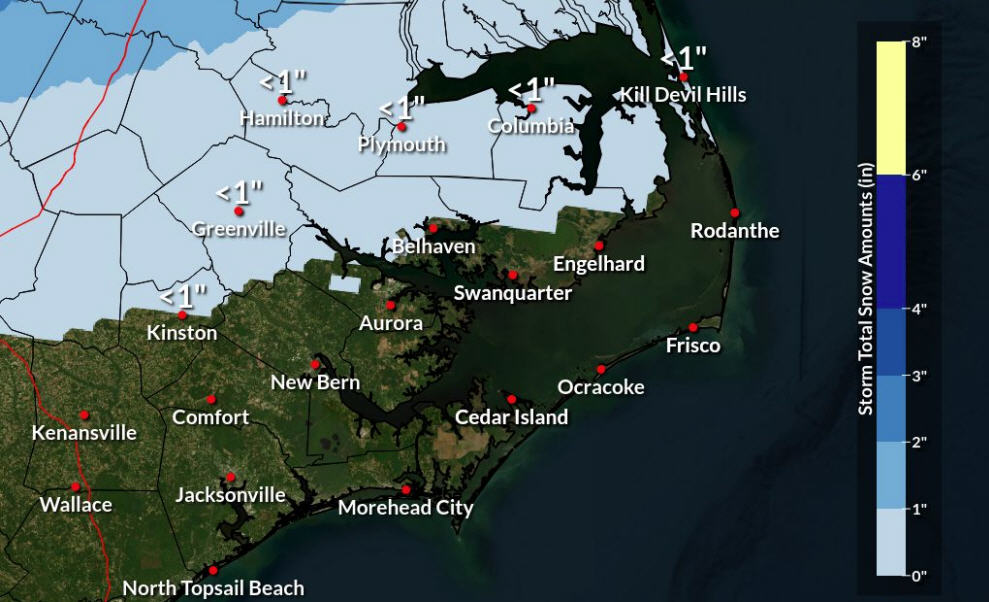

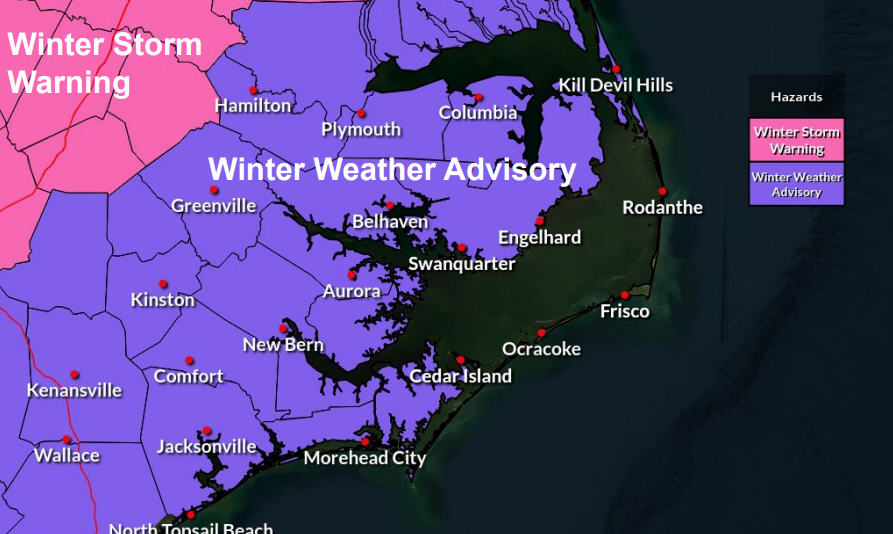

Revaluation showed wide differences in the drop in property values throughout the county, so the increase in rate will raise some tax bills higher than last year’s, while other areas will pay about the same or slightly less.

FOR MORE INFORMATION

Click here for rates for individual total tax rates, with sanitation and special districts, for the villages of unincorporated Dare County.