Dare County releases proposed budget for Fiscal Year 2024-2025

Dare County Manager Bobby Outten presented the county’s recommended budget for Fiscal Year 2024-2025 to the Dare County Board of Commissioners during the board’s meeting that was held on Tuesday, May 7, 2024.

The recommended budget includes no property tax increase, with the rate to remain at 40.05 cents per $100 of assessed value. (Example: The annual property tax for a property valued at $400,000 would be $1,602.)

The proposed budget maintains the county’s high-quality service delivery to residents, property owners and visitors, while also addressing the Dare County Board of Commissioners’ established goals. At a budget workshop held in April 2024, the board set forth the following areas of focus: long-term financial planning for capital, economic development, education, human resources and maintaining all current levels of services.

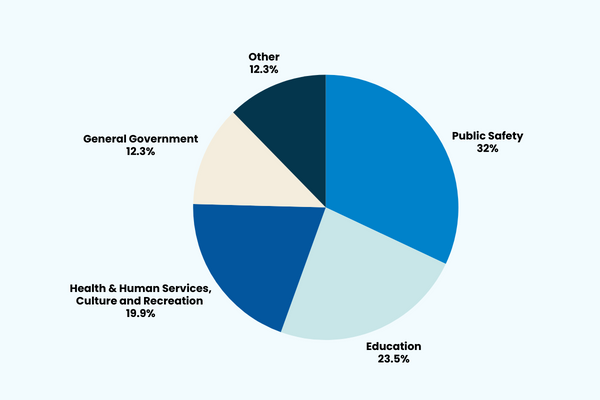

Of the proposed $136,171,205 General Fund budget, the largest expenditures are allocated to public safety, which includes the Dare County EMS Department, Dare County Sheriff’s Office and Dare County Emergency Management Department ($43.6 million/32 percent); education, which includes Dare County Schools and College of The Albemarle – Dare Campus ($32 million/23.5 percent); as well as human services ($19.9 million/14.6 percent) and general government ($16.8 million/12.3 percent). For more detailed information, click here.

Dare County Schools

Dare County’s contribution to Dare County Schools for Fiscal Year 2024-2025 is proposed to increase by almost $2.5 million to a total of $30.8 million, which consists of $1.6 million for increased pay supplements.

This additional amount is expected to place Dare County Schools in the top 20 percent of North Carolina school systems for pay supplements as well as within the top two county school systems in North Carolina in local funding per pupil.

Dare County Employees

The proposed budget provides funding for the addition of four new full-time positions and one part-time position, as well as various reclassifications and certification pay.

The new positions included in the recommended budget include the addition of an infrastructure and security administrator position in Information Technology, a leisure activities specialist position for the Dare County Parks & Recreation Department’s Roanoke Island Division, an administrative assistant position for the Dare County Sheriff’s Office, a wastewater treatment plant operator position for the Dare County Water Department and a part-time library assistant position for the Dare County Library.

Also included is a 4 percent cost of living pay adjustment for full-time and part-time benefits-eligible county employees.

PROPOSED INCREASES FOR THREE VOLUNTEER FIRE DEPARTMENT TAX RATES:

Tax rates are proposed by the volunteer fire departments that provide fire protection in the fire districts located throughout the unincorporated areas of the county. This tax is included on a property owner’s annual property tax bill as a separate line item and is based on the rate for the fire district in which the property is located.

Three volunteer fire department tax districts in Dare County have requested tax rate increases in the proposed budget in order to meet the needs of their all-volunteer departments and the residents and visitors for which they provide fire protection.

The proposed tax rate increases per $100 of assessed property value are as follows:

- Rodanthe-Waves-Salvo: $0.0955 (an increase of 2 cents from $0.755)

- Martin’s Point: $0.0523 (an increase of 0.39 cents from $0.0484)

- Roanoke Island: $0.0421 (an increase of 0.55 cents from $0.0366)

(Example: A rate increase of 2 cents per $100 of assessed property value on a $400,000 property as proposed for Rodanthe-Waves-Salvo would result in an annual increase of $80.)

PROPOSED RATE INCREASE FOR WATER CUSTOMERS IN UNINCORPORATED AREAS:

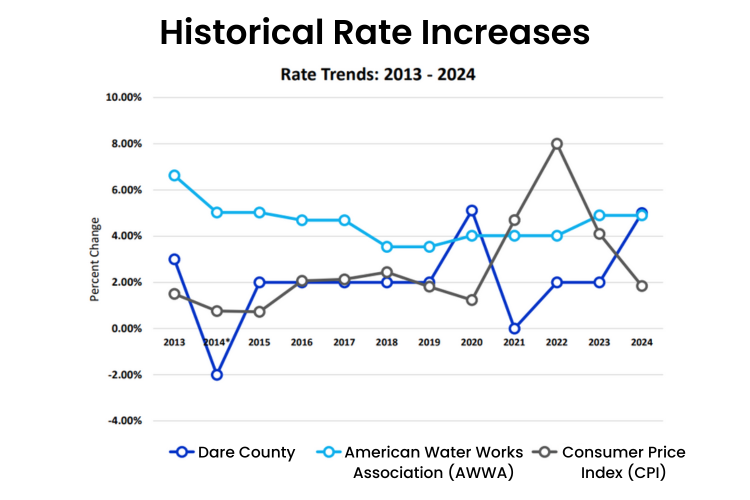

Based on Dare County’s Fiscal Year 2025 operations and maintenance (O&M) and capital budgets, the rate study recommends the county implement a 5 percent rate increase for Fiscal Year 2025 for both volumetric charges—usage/consumption charges that are over the 3,000 gallons allotted with the base rate—and base charges, which are fixed fees that cover the costs associated with providing water service, such as maintaining infrastructure and administrative costs, regardless of the amount of water consumption.

The 5 percent increase is included for all water customers in the unincorporated areas of Dare County and is due to several factors, including infrastructure improvements and technological upgrades, as well as rising operational expenses, increasing utilities, production costs and system maintenance. These improvements are necessary to meet regulatory standards and are essential for maintaining the high quality and reliability of water services in Dare County.

The average quarterly residential water bill for a one- to three-person household in the unincorporated areas of Dare County ranges from $42.59 to $70, which would therefore increase the quarterly bill by $2.13 and $3.50, respectively.

The average quarterly residential water bill for a three- to five-person household in the unincorporated areas of Dare County ranges from $70 to $120, which would increase by $3.50 and $6, respectively.

Proposed Budget Public Hearing:

The Dare County Board of Commissioners will hold a public hearing for the proposed budget during the board’s meeting that will be held at 9 a.m. on Monday, June 3, 2024 at the Dare County Administration Building, which is located at 954 Marshall C. Collins Drive in Manteo.

In-person comments on the proposed budget will be accepted during the public hearing held in Manteo, as well as the Fessenden Center Annex, which is located at 47013 Buxton Back Road in Buxton.

To view the complete proposed budget—including the manager’s letter to the Dare County Board of Commissioners that includes highlights of all proposed changes—please click here.