Myriad problems led to Rodanthe’s doomed beach houses

Second in a series.

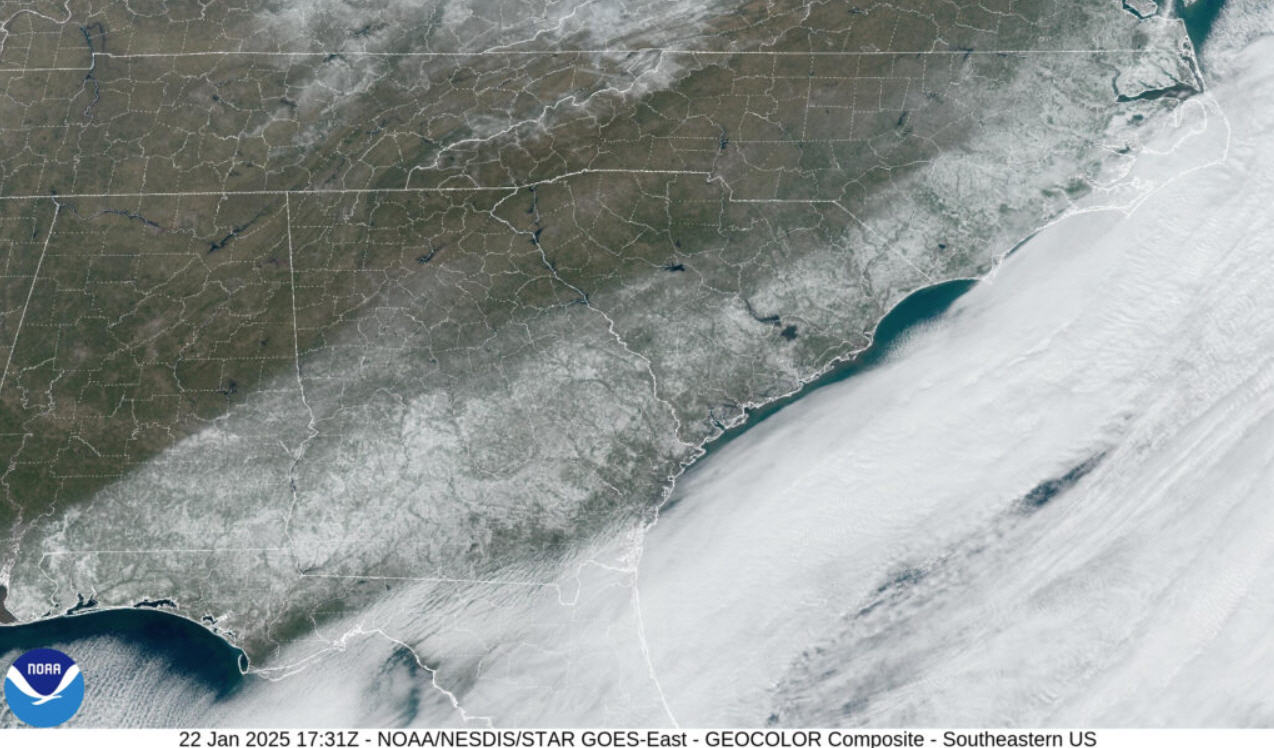

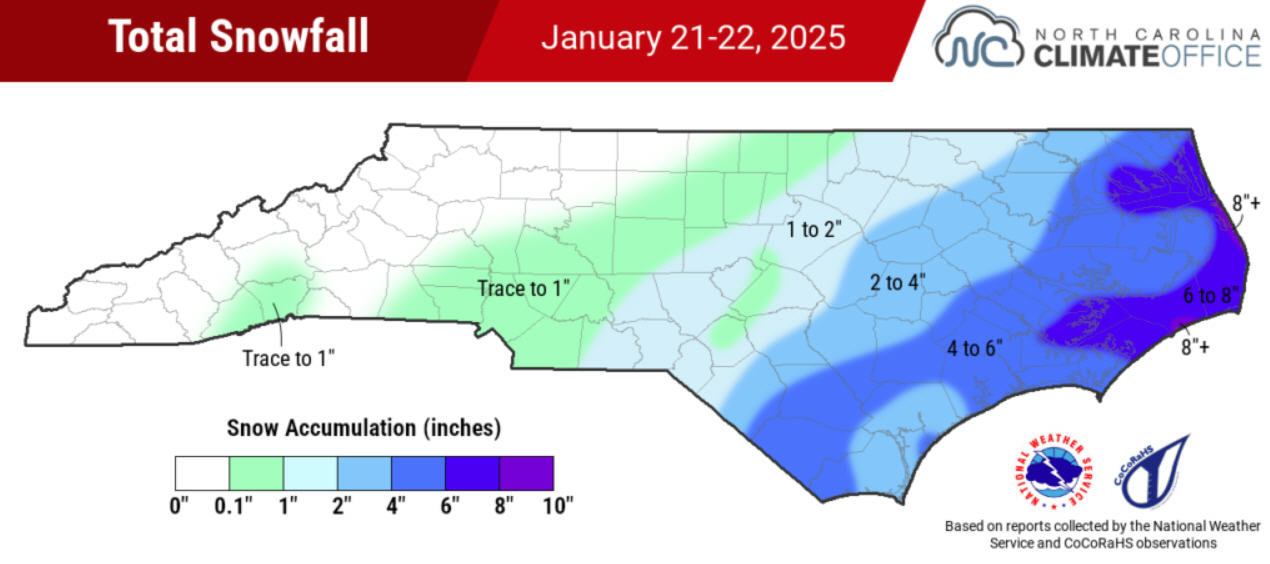

As every nor’easter blows over the Outer Banks this winter, what is top of mind for many is whether another sagging oceanfront house along the Hatteras Island beaches will succumb to the pounding waves of the Atlantic.

With a total of three large houses collapsing into the ocean so far this year, numerous oceanfront property owners in Rodanthe are scrambling to obtain permits and contractors to move their houses back from the severely eroded beach. A few of the large wooden beach houses are sitting in the surf, playing chicken with a stormy sea.

“Once it’s down, it’s considerably more difficult,” Mike Dunn, owner of W.M. Dunn Construction, LLC, of Powells Point, the contractor hired to clean up the fallen houses, said in a recent interview. “It’s cheaper, easier and more efficient to tear down a house.”

Cleanup, which is not covered by insurance, is as much as four times more expensive for the property owner, he said. A standing house can be removed for about $10,000 to $15,000; a fallen house could cost $50,000 to $100,000.

Dunn said his crew, using excavators and front-end loaders, removed 30 to 40 dump truck loads of debris that stretched along 11 miles of beach after two houses fell in May, with some crew on the job as long as 60 days. The contractor also was hired to do the cleanup of the house that collapsed in February.

“The problem with this type of work for the (owners) is they’re cleaning up everybody else’s trash,” Dunn said, referring to neighboring properties. “People lost decks, pools, fences, all that kind of stuff, during the storm.”

Although many fault the owners of the threatened or doomed beachfront houses, there is plenty of blame to go around: inconsistent real estate disclosure rules; outdated local zoning laws and building codes; gaps in state regulations; ineffective federal policies; escalating climate change impacts; inaccurate flood maps; and overall government inaction.

Whatever the reason, Dunn believes it is unfair to conclude that the property owner is at fault or irresponsible.

“They were shocked,” he said of the Rodanthe owners who lost their houses. At least two of them were from out of state, he said. “I’ve had guys literally crying to me on the phone. It’s very sad. It’s very unfortunate what happened to them — one had to file bankruptcy.”

The erosion rate in Rodanthe has long been one of the highest on the Outer Banks — as much as an annual average of 14 feet — but it has accelerated with rising sea levels, especially with storm impacts. Especially for people who are unfamiliar with the speed at which an Outer Banks beach can change, Dunn said, it can be unexpected, as it was for one of the owners.

“When he bought the house about 1 1/2 years ago, he probably had about 150 feet of beach,” he recalled. “And then, there was nothing.”

Beach nourishment is currently not available for Rodanthe, a point of contention to property owners in the small, unincorporated village. Dare County officials have said beach widening in that area would be too costly. Yet, numerous Rodanthe beachfront houses are currently listed for sale on real estate websites.

In North Carolina, real estate agents licensed by the state are required to disclose any known hazards or defects with prospective buyers, who are then to be provided a form with the information before a contract can be signed. Real estate agents are not allowed to lie if questioned about potential risks or other problems. But those same rules may not apply to out-of-state sellers, properties sold by the owner or unlicensed agents.

Bottom line, large houses are allowed to stand on the beach until they are inevitably destroyed, casting debris that is carried far and wide by currents and winds because no authority, no force of law, is demanding nor commanding that they be removed.

To wit: there’s the Federal Emergency Management Agency’s National Flood Insurance Program, a requirement for mortgaged property in a flood zone.

“The policies are not paying out anything until it’s a claim,” explained Allen Moran, an owner of Basnight & Moran Insurance Agency in Nags Head. “It’s similar to if there’s a tree over your house, they won’t pay before it falls down.”

The maximum FEMA will pay for a house when it collapses is $250,000 for the building, and $100,000 for the contents, he said. Flood insurance ratings have recently been changed to better reflect the real flood risk of property, which has increased the costs for some properties, and decreased it for others.

Under the old rates, he said, the average policy for an oceanfront property in Dare County would cost about $3,000 a year; now it will range from $4,500 a year to $6,000 a year.

Moran said the program also offers Increased Cost of Compliance, or ICC, coverage of up to $30,000 to help owners with property in designated “special flood hazard areas” meet local requirements to rebuild or repair flood-damaged structures, which includes relocation. An owner has to apply within six months of submitting a claim, and it must be damaged 50% or more or suffered a repetitive loss history with 25% or greater loss in each loss.

Still, as one FEMA official explained, with the increasing number and severity of disaster threats, addressing measures — whether proactive or responsive — for high-risk properties is complex and beyond the capability of one agency.

“We believe insurance coupled with mitigation is key to disaster resilience against climate change – especially flooding, the most common and destructive threat,” said FEMA Deputy Associate Administrator for Resilience David Maurstad in an email response to Coastal Review. “In the end, no single government and private sector entity can develop and implement a mitigation strategy, especially not today with climate change.”

Currently, there is a total of 4.7 million national flood insurance policies in force, according to Maurstad’s email. For context, the agency pointed out that the 2020 U.S. Census data reports 81 households in Rodanthe. Of all the nation’s disasters, flooding is the most common and costliest, impacting 98% of the United States.

“Living in close proximity of a water source, such as a coastline, the risk definitely increases that a structure may be impacted by flooding,” Maurstad wrote.

But since property development decisions are not made by FEMA, he noted, the location of properties are local decisions. “Communities that participate in the NFIP have, at a minimum, adopted the minimum federal and state requirements for floodplain management,” he said.

Costs for demolition or relocation are not covered under the National Flood Insurance Act. But they used to be. Adopted in 1988, the Upton-Jones Amendment provided coverage for structures in imminent danger on an eroded shoreline. The program would pay up to 40% of the policy to relocate endangered structures and up to 110% of the policy to property owners to demolish and remove their structure. At the time, the maximum amount of an oceanfront policy was $185,000 for the structure and $60,000 for its contents.

The amendment was repealed in 1994, and no effort since to revise it has gained traction in Congress.

As it stands now, removing the property from the risk is not the role of the flood insurance program.

“Essentially we are distinguishing between an insurance program which pays out for insured losses versus mitigation grant programs which reduce the risk of flooding to structures and therefore the risk of insurance payouts when the mitigation is focused on insured properties,” explained Maurstad.

FEMA currently offers numerous grants to address flood risk. Dare County’s Hazard Mitigation Grants Program, which offers local, permanent residents an opportunity to apply for funds to elevate their homes above current base flood levels, has been popular and effective. Other competitive grants are available through the Building Resilient Infrastructure and Communities program, which offers funds for projects such as flood control, utility protection, stabilization and retrofitting, and Flood Mitigation Assistance Grants, for projects that reduce or eliminate repetitive flood risks.

On Aug. 12, FEMA published a funding opportunity that increased the funding level for Flood Mitigation Assistance by five times, from $160 million to $800 million, Maurstad said. To date, the program has mitigated more than 8,000 FEMA-insured properties over the last 20 years. Also, he said, home acquisitions are eligible through the Building Resilient Infrastructure and Communities program funds and the Hazard Mitigation Grant Program.

Congress established the National Flood Insurance Program in 1968 in response to disaster costs following severe flood and storm damage from Hurricane Betsy in 1965, the nation’s first billion-dollar hurricane. But the original intent to provide government-subsidized property insurance for Americans living in flood-prone areas has become a Pandora’s box of budget deficits, political division and regional rivalries, pitting coastal residents against inland property owners, cities against rural communities, and victims of ocean surge against those who’ve suffered flash flooding from rising rivers and intense rains.

Congress established the National Flood Insurance Program in 1968 in response to disaster costs following severe flood and storm damage from Hurricane Betsy in 1965, the nation’s first billion-dollar hurricane. But the original intent to provide government-subsidized property insurance for Americans living in flood-prone areas has become a Pandora’s box of budget deficits, political division and regional rivalries, pitting coastal residents against inland property owners, cities against rural communities, and victims of ocean surge against those who’ve suffered flash flooding from rising rivers and intense rains.

As described in a 32-page Congressional Research Service paper on the program, updated in October, the program has been plagued by underfunding and dysfunctional politics, especially as disaster costs have been spiking. Ridden with acronyms, complicated rules and changing risk ratings based on state flood maps, the program is difficult to understand even for the private insurance agents who handle the flood policies.

Since the end of fiscal year 2017, there have been no less than 21 short-term congressional reauthorizations of the program, with the most recent due to expire Dec. 16. Congress canceled $16 billion of program debt in 2017, which allowed it to cover claims for hurricanes Harvey, Irma and Maria. But the insurance program currently owes $20.525 billion to the U.S. Treasury, leaving $9.9 billion in borrowing authority from a $30.425 billion limit in law, according to the Congressional Research Service document.

Despite its fiscal woes, FEMA is still focused on expanding the number of properties covered by flood insurance, and is working closely with insurance and real estate industry professionals and community leaders to drive purchases, Maurstad, the FEMA administrator, said.

But flood insurance is hardly a panacea. Financial preparedness is also necessary to rebuild after a disaster, he added, helping not only restoration of homes and communities, but also reducing the need for federal disaster assistance.

Prompted by a petition in January 2021 from the Association of State Floodplain Managers and the Natural Resources Defense Council seeking revisions of the current floodplain management standards, Maurstad said, FEMA is in the process of analysis of potential updates in regulations and policy.

Eroding shorelines that threaten existing development reflect only a portion of where flood insurance is important. But climate change impacts will only increase flood risks and storm damages that will require coming together to find solutions, or adaptation.

“It is the urgent task of each of us, as a nation of stakeholders,” Maurstad wrote. “Disaster resilience is a cross-cutting and integrated effort among a wide range of stakeholders from the public and private sectors. Each area of expertise and sphere of responsibility affects another. It is all part of one, all-encompassing story.”