From Wobx.com

Less than eight months after reaching a settlement that raised insurance rates by a statewide average of nearly 10 percent on rental properties, the North Carolina Rate Bureau has asked again to increase the cost of new and renewing policies starting next June by more than half.

The N.C. Department of Insurance announced Monday the group representing insurance companies is asking for a 50.6% statewide average rate increase for dwelling policies.

Fire policies would go up by an average of 17 percent for buildings and 5 percent for contents. Extended coverage for buildings and contents would be raised by an average of 59.8 percent.

Dwelling insurance policies are offered to non-owner-occupied residences of no more than four units, including rental properties, investment properties and other properties that are not occupied full-time by the property owner.

The last time the N.C. Rate Bureau made a dwelling rate filing was in August 2022, when it requested an average statewide increase of 42.6 percent.

While fire policy rates remained unchanged this year for some parts of northeastern North Carolina, extended coverage for buildings was raised by just over 12 percent and contents by between 11.5 and 13 percent.

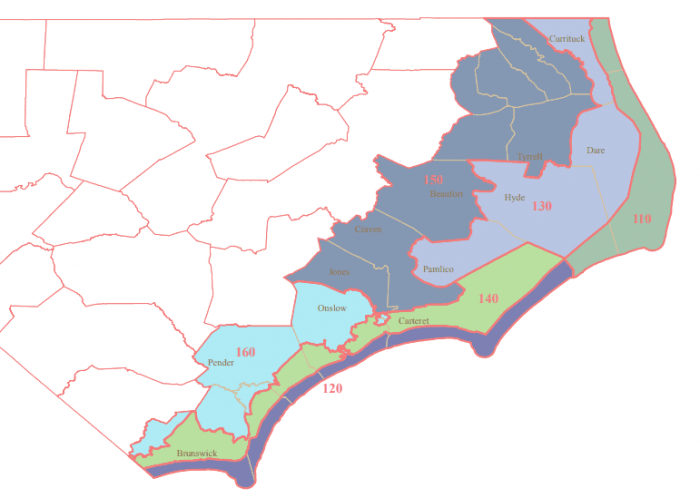

All areas east of the sounds from Carova Beach to Ocracoke as well as Roanoke Island are in Residential Insurance Territory 110. Currituck, Dare and Hyde mainland areas are in Territory 130. Camden, Pasquotank, Perquimans, Chowan, Tyrrell and Washington counties are in Territory 150.

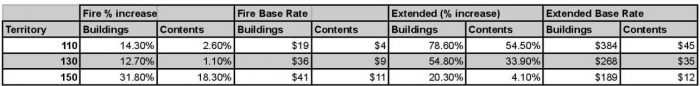

The request filed on July 13, with an effective date of June 1, 2024 for the territories of the Greater Outer Banks:

e requested increase on extended contents and buildings policies in Territory 150 is the lowest in the state.

The biggest hike proposed for extended coverage are Lenoir and Duplin counties (Territory 190) of 106 percent for buildings and 78.3 percent for contents.

Fire rates in Wake and Durham counties (Territory 270) would only experience a 3.3 percent rise for buildings, and a reduction of 7.3 percent for contents.

Hoke and Scotland counties (Territory 250) and Greene and Wayne counties (Territory 180) are the only other territories to receive a discount on their fire contents rates in the 2024 filing.

Wilson and Edgecombe counties, Territory 210, would be hit with the highest fire rate increases of 33.5 percent for buildings and 19.8 percent for contents.

Comment on the filing will be accepted through August 25, 2023 by email

NCDOI.2023DwellingandFire@ncdoi.gov or in writing to Kimberly W. Pearce, Paralegal III, 1201 Mail Service Center, Raleigh, N.C. 27699-1201.

All public comments will be shared with the Rate Bureau. If Department of Insurance officials do not agree with the requested rates, they will be negotiated with the N.C. Rate Bureau. If a settlement cannot be reached within 50 days, a hearing will be called.

Related links:

- 2023 Dwelling Fire and Extended Coverage Rate Filing Part 1 of 2

- 2023 Dwelling Fire and Extended Coverage Rate Filing Part 2 of 2