Moody’s Investors Service has upgraded Dare County’s issuer bond rating from Aa2 to Aa1, Dare County Board of Commissioners Chairman Bob Woodard announced at the board’s Jan. 19 meeting.

Moody’s Investors Service has upgraded Dare County’s issuer bond rating from Aa2 to Aa1, Dare County Board of Commissioners Chairman Bob Woodard announced at the board’s Jan. 19 meeting.

A rating of Aa1 is only one step below AAA, the highest rating that can be assigned to an issuer’s bonds by any major credit rating agency.

In addition, Moody’s has assigned a rating of Aa2 to Dare County’s $26.4 million Limited Obligation Bonds (LOBs), Series 2021A and upgraded the rating on the county’s outstanding LOBs from Aa3 to Aa2.

The upgrade to an issuer bond rating of Aa1 reflects the county’s positive operating performance and strong financial position, which is a result of at least six years of operating surpluses. Moody’s has attributed such surpluses to Dare County’s implementation of formal financial policies and long-term planning efforts.

When making the announcement, Chairman Woodard thanked Finance Director David Clawson for his hard work and expertise in managing the county’s finances. Clawson has been instrumental in recommending strong fiscal policies adopted by the Board of Commissioners that have proven to strengthen the county’s financial position.

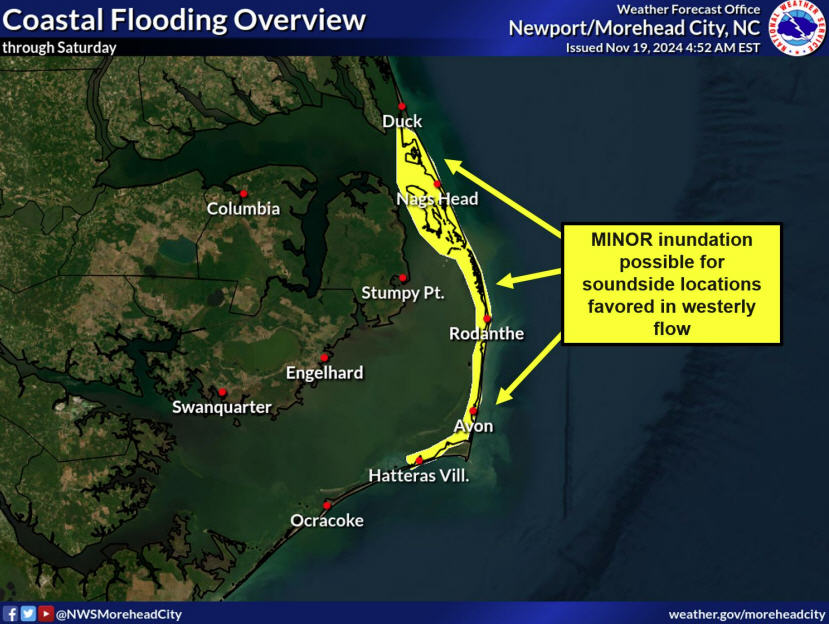

Despite the credit challenges that come with being a coastal community that has significant exposure to hurricanes and flooding, one of Dare County’s primary credit strengths is its large and stable tax base due to its status as a tourist destination.

The significant number of second homes and vacation rental properties within the county contribute to its strong property wealth levels — and also result in a full value per capita that is well above medians for the rating category.

Additional credit strengths noted by Moody’s include low long-term liabilities and manageable fixed costs. The rating agency also indicated that these long-term liabilities will remain manageable because of the county’s use of dedicated occupancy and sales taxes for capital needs.

The upgraded issuer bond rating marks a significant accomplishment by Dare County, as improved bond ratings make it possible for the county to borrow money at better rates when needed in order to finance important capital projects. Finance Director David Clawson estimates that the county will save $426,000 in interest over the life of the loan for the most most recent bond offering.

Such capital projects currently underway in Dare County include the construction of a new academic building on College of The Albemarle’s Dare Campus in Manteo, the new Dare County Animal Shelter on Roanoke Island that is slated to open in March, as well as the renovation of the Dare County Department of Health and Human Services’ facilities.

For more information, visit www.DareNC.com.