Causey settles again with insurance companies, another rental home rate hike on the way

North Carolina Insurance Commissioner Mike Causey has reached a settlement with companies that insure rental homes, which means rates for some coverage will be jumping again for a second straight year.

The Republican who is running for a third term this fall announced late Thursday he had reached an agreement with the North Carolina Rate Bureau that will lead to an average increase statewide of 8% for dwelling policies starting November 1.

The rate bureau submitted a filing in July 2023 that asked for a 50.6 percent statewide average rate increase for fire and extended coverage of dwelling policies, which are offered to non-owner-occupied residences of no more than four units, including rental properties, investment properties, and other properties that are not occupied full time by the property owner.

“I am happy that we were able to save North Carolina consumers more than $151.7 million per year in this rate case over what the insurance companies requested,” Causey said in a statement.

In January 2023, Causey granted the Rate Bureau a hike that averaged around 10 percent statewide on dwelling policies.

A public hearing on the latest request was scheduled for July 22, after it was originally postponed in April.

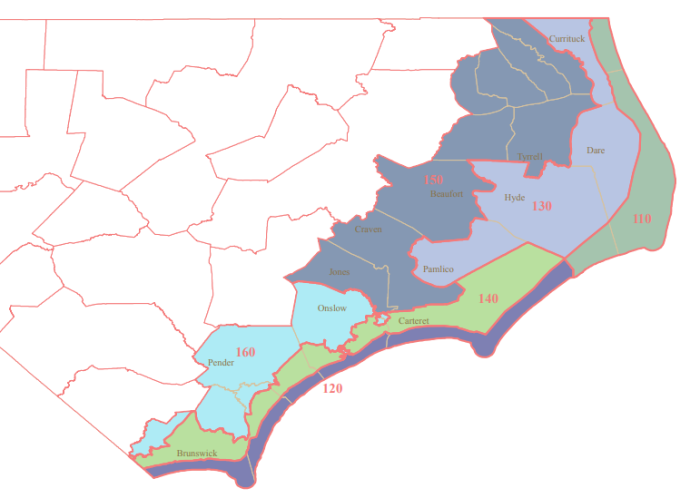

The press release from the Department of Insurance noted that the increases that will hit this fall vary by territory.

All areas east of the sounds from Carova Beach to Ocracoke as well as Roanoke Island are in Residential Insurance Territory 110. Currituck, Dare and Hyde mainland areas are in Territory 130. Camden, Pasquotank, Perquimans, Chowan, Tyrrell and Washington counties are in Territory 150.

The eight-page settlement announced Thursday holds rates for fire building and contents in all territories, while raising extended coverage buildings by 14.9% in Territory 110, 5.8% in Territory 130 and 2.5% in Territory 150. There is no change to the rates charged for extended coverage of contents.

The original request called for an increase of more than 75 percent on new and renewing wind and hail policies for vacation and full-time rental houses on the Outer Banks.

It also would have hit those in Territory 110 the hardest for extended coverage of buildings (78.6%) and contents (54.5%), while Territory 150 would have seen the area’s highest increase for fire coverage of buildings (31.8%) and contents (18.3%).

Causey has reached a settlement in every request made by the Rate Bureau, both on property and auto insurance changes, since he was first elected commissioner in 2016.

“I’m also glad that we were able to avert a potentially lengthy and costly hearing on this case,” Causey said in his statement. “Our top-notch legal, actuarial and property and casualty experts at the Department worked diligently to help protect the consumers’ pocketbooks by limiting this increase to 8%.”

He has scheduled a hearing for October on a request to raise regular homeowners insurance policies by as much as 45% along the Outer Banks.

That request drew more than 25,000 phone calls, emails and letters from North Carolinians about the proposed rate hikes — including many of the state’s elected officials.

Well over 100 people spoke out against the proposal during a public hearing in April.

Among those who attended the hearing in Raleigh in person were Willo Kelly and Donna Creef of the Outer Banks Association of Realtors, who have been at the forefront of battling the inequities in insurance rates our area has faced when compared to areas well inland.

And on Tuesday, Causey announced he had rejected a request to raise mobile home insurance rates and has set that hearing for next April.

The industry is asking for the mobile home rate hikes over a three-year period that raises fire insurance rates by more than 120 percent and casualty policies by over 80 percent in coastal counties by 2027.

Causey’s opponent in the November general election, Democratic state Sen. Natasha Marcus of Mecklenburg County, had not released a statement as of Thursday evening.

But she has been openly critical of Causey’s operation of the Insurance Department, and how has run the rate filing process.

Causey has also come under fire after a friend and donor cost state taxpayers nearly $14,000 in hotel, meals and other expenses after being hired as the commissioner’s driver with a salary of over $84,000.

An investigation by The News & Observer found Roger Blackwell, 77, also had inconsistent job titles and accompanied Causey on long work trips to locations as far as New Mexico.

Although Willo Kelly and Donna Creef are looking out for the realtors it does trickle down to the rental homeowners which is good.