Dare County expresses strong opposition to proposed homeowners insurance rate increase

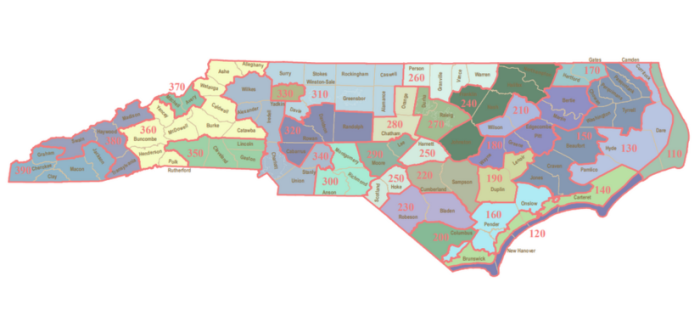

The North Carolina Rate Bureau has filed a request with the North Carolina Department of Insurance that proposes to increase homeowners insurance rates statewide by an average of 42.2 percent effective August 1, 2024.

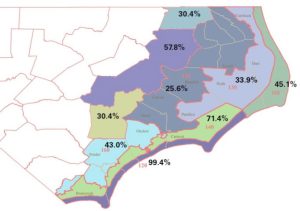

If approved by the North Carolina Department of Insurance, homeowners insurance rates in Dare County would increase by 45.1 percent for properties located in beach communities (Territory 110) and increase by 33.9 percent for properties located in inland areas (Territory 130).

Based on $200,000 in coverage, these proposed rates would result in a substantial increase in the cost of Dare County homeowners insurance policies: an increase of $1,312 for those with homes in the beach communities and an increase of $602 for those with homes in the inland areas of the county. With these proposed increases and $200,000 in coverage, the base rate for homeowners insurance in Dare County beach areas would therefore increase to $4,220 and the base rate for inland areas would increase to $1,775.

The Dare County Board of Commissioners strongly opposes these astronomical homeowners insurance rate increases, which, if implemented, would make homeownership unattainable for many first-time buyers and be extremely difficult for current homeowners to afford—particularly Dare County’s teachers, first responders, medical personnel, government employees and service industry staff, among many others.

The Dare County Board of Commissioners strongly opposes these astronomical homeowners insurance rate increases, which, if implemented, would make homeownership unattainable for many first-time buyers and be extremely difficult for current homeowners to afford—particularly Dare County’s teachers, first responders, medical personnel, government employees and service industry staff, among many others.

In addition, these excessive homeowners insurance rates would also be passed along to those who rent homes in Dare County, leading to significantly increased rental rates in a market where there is already a severe lack of housing for members of the area’s essential workforce.

Furthermore, as home values in Dare County continue to increase, insurance premiums will also increase exponentially, forcing many homeowners to opt for higher deductibles in order to avoid the exorbitant insurance premiums. These higher deductibles would result in Dare County homeowners receiving smaller insurance claim payments, which will directly impact their ability to recover from storm damage or other disaster events.

The Dare County Board of Commissioners has expressed its opposition and concerns to the North Carolina Rate Bureau’s proposed homeowners insurance rate increases in a letter sent to North Carolina Commissioner of Insurance Mike Causey’s office.

In this letter, the board states that “all North Carolinians need attainable coverage at reasonable rates” and requests that the 2024 homeowners insurance rate increases be denied by North Carolina Commissioner of Insurance Mike Causey or that a hearing be scheduled. To view a PDF of the letter, click here.

Take Action! Submit Your Public Comment to the North Carolina Department of Insurance:

Individuals who are opposed to the proposed homeowners insurance rate increases are strongly encouraged to express their concerns by submitting a public comment to the North Carolina Department of Insurance before the February 2, 2024 deadline. Public comments in opposition to the increase can be submitted in the following four ways:

In Person:

A public comment forum will be held on Monday, January 22, 2024 from 10 a.m. to 4:30 p.m. at the North Carolina Department of Insurance’s Jim Long Hearing Room, which is located within the Albemarle Building at 325 N. Salisbury St., Raleigh, N.C. 27603.

Virtually:

A virtual public comment forum will be held simultaneously with the in-person forum listed above on Monday, January 22, 2024 from 10 a.m. to 4:30 p.m. The link to this virtual forum will be: https://ncgov.webex.com/ncgov/j.php?MTID=mb3fe10c8f69bbedd2aaece485915db7e

Email:

Emailed public comments should be sent by Friday, February 2, 2024 to 2024Homeowners@ncdoi.gov.

Mail:

Public comments can also be submitted by mail and must be received by Friday, February 2, 2024. Please include your full name and address and send your written public comments to: Kimberly W. Pearce, Paralegal III, 1201 Mail Service Center, Raleigh, N.C. 27699-1201.