State Insurance Commissioner Mike Causey has announced a settlement has been reached with insurance companies that will allow rates to increase an average statewide of 9.9 percent for rental properties starting in June.

Last August, the North Carolina Rate Bureau requested a statewide average 42.6 percent rate hike for dwelling policies spread over two years.

“I am happy to announce that North Carolina homeowners will save more than $104 million a year in premium payments compared to what the Rate Bureau had requested,” Commissioner Causey said in a statement released Tuesday. “I am also pleased that the Department of Insurance has avoided a lengthy administrative legal battle which could have cost consumers time and money.”

“While any increase in insurance rates is not welcome news, I am glad that Commissioner Causey was able to negotiate rate increases that are more reasonable than those originally sought by the NC Rate Bureau,” said Donna Creef, Outer Banks Association of REALTORS Government Affairs Director.

“The original increases requested were not sustainable for Outer Banks property owners or elsewhere in North Carolina,” Creef said.

Dwelling insurance policies cover non-owner-occupied residences of no more than four units, including rental properties, investment properties and other properties that are not occupied full-time by the property owner. Homeowner policies that cover primary residences are a separate category.

According to the Rate Bureau, a consent decree signed Monday approved an overall statewide average increase of 9.9% for all dwelling forms, and approved revisions to base rates, windstorm or hail exclusion credits, and wind mitigation credits.

Causey said the increase will take effect on new and renewed policies beginning on or after June 1, with the highest average premium increase in any North Carolina territory of $31.

The N.C. Rate Bureau is made up of insurance industry representatives, researches, and experts that provide the state insurance commissioner data that reflects rate increases or decreases needed by the industry.

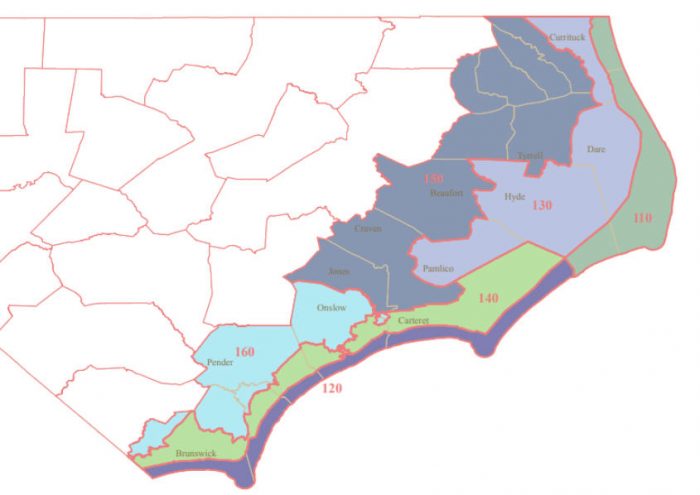

For all areas east of the sounds from Carova Beach to Ocracoke as well as Roanoke Island, Territory 110, fire policies for buildings and contents will remain unchanged.

Extended coverage for Territory 110 will increase 12.6 percent for buildings and 11.5 percent for contents.

On the Currituck, Dare and Hyde mainland areas, Territory 130, fire rates will also remain the same, with extended coverage for buildings rising 12.3 percent and contents 13 percent.

Territory 150, which includes Camden, Pasquotank, Perquimans, Chowan, Tyrrell, and Washington counties, will see a 6.9 percent increase for fire policies for buildings while contents remain unchanged. Extended coverage for buildings will rise 12.1 percent and contents 9.1 percent.

The latest increase follows a dwelling policy rate filing the Department of Insurance and Rate Bureau settled in March 2021 that had no increase in fire policies, and a 10 percent increase for buildings under extended coverage. It also had a 10 percent increase for extended coverage of contents in territories 110 and 130, and 2.9 percent in Territory 150.

A request by the Rate Bureau in November to raise rates for mobile homes is still pending with the Department of Insurance.