UPDATED: State Insurance Commissioner objects to rate increase for rentals, sets hearing for April 2023

State Insurance Commissioner Mike Causey has announced he will oppose a request from insurance companies that cover rental and investment properties for a significant increase in premiums for dwelling policies on the Outer Banks and in northeastern North Carolina spread over the next two years.

The N.C. Tribune reported Causey has set an April 17, 2023, hearing date for the proposed hike.

The North Carolina Department of Insurance received the dwelling insurance rate filing from the North Carolina Rate Bureau on August 18.

Dwelling insurance policies cover non-owner-occupied residences of no more than four units, including rental properties, investment properties and other properties that are not occupied full time by the property owner. Homeowner policies that cover primary residences are a separate category.

“Under the NCRB proposal, the increases would be felt statewide with most consumers seeing a double-digit increase,” the Department of Insurance said in a news release.

“I am glad Commissioner Causey has filed the hearing request in recognition that the requested 42.6% rate increase is not feasible…reasonable or sustainable for property owners,” said Donna Creef, Outer Banks Association of REALTORS Government Affairs Director.

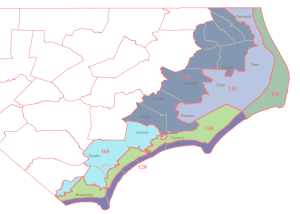

For policies covering homes in Territory 110, all areas east of the sounds from Carova Beach to Ocracoke as well as Roanoke Island, the Rate Bureau is asking for fire policy premiums to go up 7 percent for new and renewing policies effective April 1, 2023. Contents rates would drop by 2.8 percent.

The request asks for extended coverage, which includes wind and hail, to go up 33.0 percent for buildings and 21.8 percent for contents on April 1, 2023 and again on April 1, 2024.

On the Currituck, Dare and Hyde mainland areas, Territory 130, fire rates would increase 4.5 percent while contents covered by fire policies would decrease 5.1 percent in April 2023.

Extended coverage for Territory 130 would increase 23.3 percent for building and 12.9 percent for contents in April 2023 and April 2024.

Territory 150, which includes Camden, Pasquotank, Perquimans, Chowan, Tyrrell and Washington counties, fire policies would see hikes of 24.9 percent for buildings and 13.5 percent for contents. Extended coverage only goes up 5.8 percent for buildings, while contents drops 3.1 percent, in both years.

Although the request is spread over a two-year period, such a substantial rate increase is a cause for concern,” Creef said.

The rate filing follows the dwelling policy rate filing the Department of Insurance and Rate Bureau settled in March 2021 that had no increase in fire policies, and a 10 percent increase for buildings under extended coverage. It also had a 10 percent increase for extended coverage of contents in territories 110 and 130, and 2.9 percent in Territory 150.

Creef noted that the effectiveness of the 2021 increase has not been realized yet.

A written public comment period on the latest proposed hike was held in September. It’s possible Causey could negotiate a compromise rate between now and the April hearing. That’s what happened in 2020, when the compromise rate increase came out at at a 7.6% statewide average, according to The N.C. Tribune.