Dare County’s current $101 million budget is funded with a variety of sources, including federal and state money, grants, fees collected, and tax revenues derived from property taxes.

Property tax revenues in the current budget total $49 million, slightly less than half the amount needed to pay for the total current budget that expires on June 30, 2013.

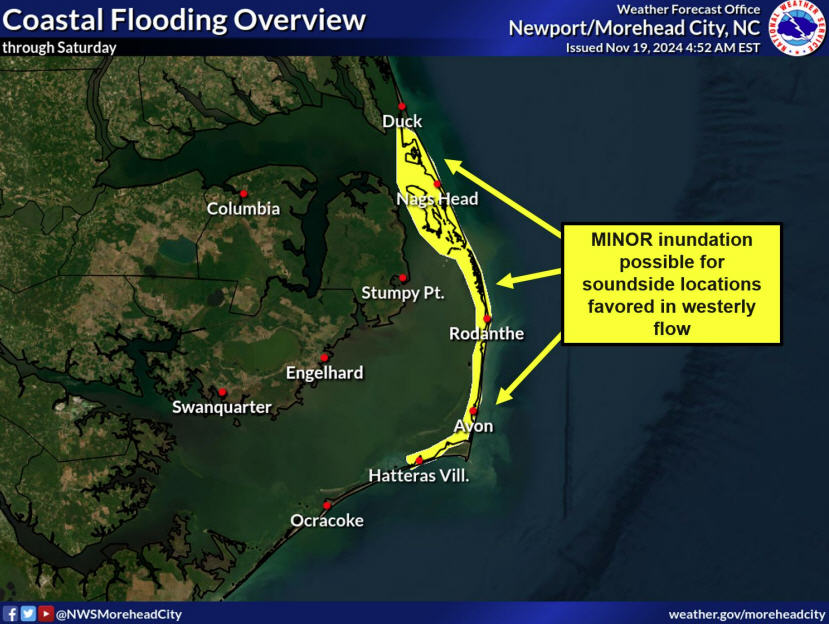

During the last few years, foreclosures, the recession, and damage and/or loss of properties from storms has forced property values down from $17 billion to $12 billion.

If the current tax rate of 28 cents per $100 is applied against the total of the new property values, the resulting revenues would be just $33.6 million – a $15.4 million shortfall in supporting the current budget of $101 million.

State law mandates that local governments must determine the “revenue neutral” rate each time that there is a revaluation conducted. That rate is what it would have to be in order to collect the same amount of property taxes as those used to support the current budget.

Dare County announced this week that the revenue neutral rate based on the new property tax base is 41 cents per $100 of value – an increase of 13 cents.

Because the dip in property values has varied widely between locations and such factors as whether properties are oceanfront or mainland, the resulting tax bills, if based on the revenue neutral rate, would be higher for some, lower for others.

The property tax base decline is 29.1 percent countywide but ranges from 22 percent decrease in values in Manteo to a 43 percent decline in Salvo. The higher the decline, the lower the resulting projected taxes.

But even if you understand thus far, you still don’t know what your taxes are going to be next year! That will depend on how county officials budget for the new fiscal year beginning July 1, 2013.

Although unlikely, if they budget to spend less next fiscal year, the 41-cent rate could drop; if the new budget increases expenditures over the current budget, the rate could increase.

The new values set on individual properties are scheduled to be mailed to property owners on Feb. 25. Those who disagree with the value placed on their property will have the opportunity to appeal.

And appeals shouldn’t just be sought by those who think that their homes are valued too high. There also are pitfalls for those whose properties are valued too low.

Following Hurricane Irene, problems surfaced for some who had the proper amount of coverage so that they could replace their home or to pay off their loan. But, although they enjoyed a few years of low taxes based on a too-low tax value, it cost them in the long run.

FEMA rules dictate that if damage is more than 50 percent of the value of the structure, the property owner must agree to raise the building before the county can issue a building permit. And what does the county use to determine a house’s value unless a recent appraisal is available? Tax value.

You can see that if your tax valuation is too low, you will more quickly reach that 50 percent mark and perhaps be forced to raise your house or structure, even if you don’t need to.

The new valuations also will apply to the special tax districts used to support community centers and fire departments. Revenue neutral rates haven’t been announced yet for the individual districts but can be expected to increase about 30 to 43 percent above current rates to garner the same tax revenues.

So your head is swimming with all this tax stuff? There’s more.

Those who allow their mortgage companies to take care of purchasing their insurance coverage should contact the mortgage-holder and make sure that they don’t insure the house based on tax value.

Replacement value and tax value are rarely the same amount. Tax values are usually much less, which could translate into a major problem if the home is damaged or destroyed. Tax value also is often less than the mortgage owed on the property.

Unfortunately, some Dare County homeowners have learned this lesson the hard way following major storms.

In a number of cases, insurance coverage provided through their mortgage companies would neither replace the home nor pay off the existing mortgages.

A good practice is to ask the company to send copies of all the policies insuring property so that the property owner can check to make certain that their structure is adequately covered. Frequently, homeowners also have found that they had no contents coverage.

(Sandy Semans Ross, former managing editor of The Outer Banks Sentinel, is a freelance writer who lives in Stumpy Point. You can read more of her blogs at www.sunshineobx.blogspot.com.)

FOR MORE INFORMATION

Presentation of tax assessor on revaluation at Dare Commissioners’ meeting on Feb. 18: http://www.darenc.com/news/2013/id_281b.pdf

Sample revaluation notice: http://www.darenc.com/news/2013/id_281a.pdf

Revaluation FAQs: http://www.darenc.com/tax/apprfaqs.asp