Bigger Flood Insurance Bills Likely on the Way

With a Dec. 8 renewal deadline looming, lawmakers in Washington are set to decide the fate of the debt-ridden National Flood Insurance Program (NFIP), something that affects roughly 9,000 Dare County property owners.

The NFIP, which has been renewed in the House, now awaits action in the Senate, and that could conceivably mean changes to the measure. But local experts say that, based on what they see now, higher flood insurance bills are on the way.

“Everyone is going to be paying more in assessments and surcharges,” said Willo Kelly, government affairs director for the Outer Banks Association of Realtors and the Outer Banks Homebuilders Association. “Your flood insurance bills are going to look like your cable or phone bill.”

After receiving a three-month extension this fall, the U.S. House of Representatives voted on Nov. 14 to renew what is now known as the 21st Century Flood Reform Act for a five-year period. The Senate must act on it before the December deadline in order for the program to continue.

“The clock is ticking,” noted Kelly.

Administered by the Federal Emergency Management Agency (FEMA), the NFIP provides flood insurance to roughly five million property owners across the country. Created in the late 1960s to provide property owners with affordable flood insurance, the program was driven into debt by storms such as Hurricane Katrina in 2005 and Superstorm Sandy in 2012.

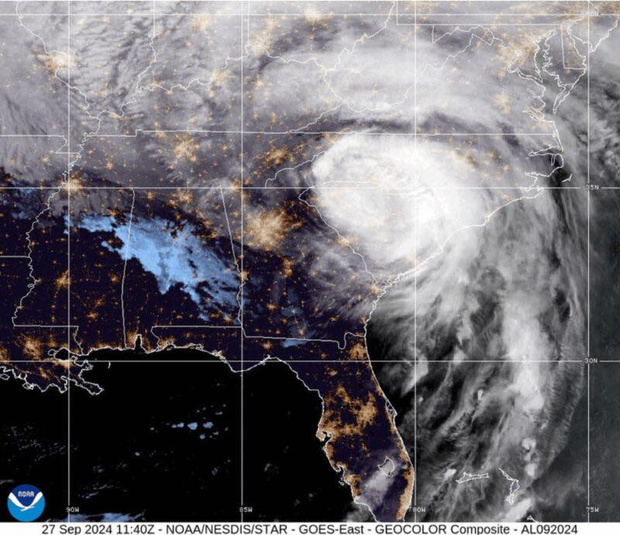

Many have called for an overhaul of what has long been referred to as a defective program that, following this fall’s particularly harsh hurricane season, currently carries a 35 billion dollar debt.

“This bill is much better than what they were considering in September,” Kelly told the Sentinel, adding that she still has significant concerns.

Among the proposed changes is an increase in annual surcharges, from $25 to $40 for primary residences in the program, and $250 to $275 for second homes.

The bill also calls for a 15-percent reserve fund assessment to increase by one percent each year for every policyholder until FEMA has reached a one billion dollar collection rate per year.

The new legislation removes prior hurdles when it comes to private insurers offering flood insurance. However Kelly expressed some reservations about the inclusion of private flood insurers, adding that such a move gives private insurers access to a multitude of information. “The private market wants to participate now because rates are so high,” she added.

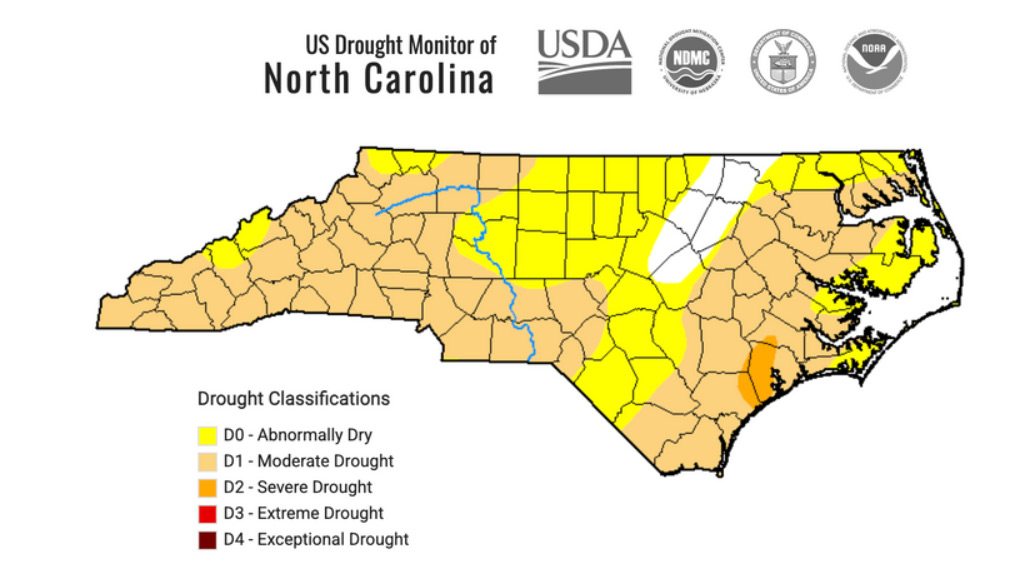

Also of major concern for coastal property owners, noted Dare County Planning Director Donna Creef, is a proposed coastal and inland rating system, which she said reflects a bias against coastal development and will translate into increased rates for those living along the coast.

Currently a property’s proximity to water is already factored in to premium rates, along with other variables such as the height of the dwelling’s first floor.

“Water is water, and when it is in a house, it doesn’t matter if it came from the Atlantic Ocean or the Mississippi,” Creef said. She cited the devastation in Houston from Hurricane Harvey, which she noted was caused primarily from rainfall.

Under the bill, properties with at least two past claims would see at least 10 percent rate increases each year until those rates reflected its current risk. These “repetitive loss” properties account for a large portion of FEMA claims – with some estimates as high as 30 percent.

The bill also calls for FEMA to offer full disclosure of flood hazards and past flooding history to potential homeowners and realtors.

In addition, it requires communities with 50 or more “repeatedly flooded properties” to develop a plan for mitigating flood risks. Creef said developing such a plan could be costly for local governments and Dare County, she added, has an aggressive ranking in FEMA’s community rating system (CRS).

The CRS is an incentive program that encourages communities to go beyond minimum federal regulations to reduce flood hazards and risks in their area. This spring, Dare County increased its ranking to a Class 7, which translated into a 15 percent discount in the premium cost of flood insurance for policies within the unincorporated areas of Dare County.

U.S. Rep. Walter Jones (R-NC 3rd District) voted against the 21st Century Flood Reform Act on Nov. 14. His office did not respond to the Sentinel’s request for comment.