By JOY CRIST

We?re at least a year away from the new flood maps being implemented, but the preliminary maps which came out in June of 2016 is a topic that has certainly garnered attention in the past couple of weeks.

Heavily attended public meetings were held on January 11, 12, and 13 ? including one in Buxton that attracted 50 people – and on January 17th, a presentation at the Board of Commissioners? (BOC) Meeting by Dare County Planning Manager Donna Creef led to six recommended actions being approved.

So what?s happening with the new flood maps, and how are homeowners going to be affected?

Essentially, the good news is that many homeowners on Hatteras Island are being moved to a less-risky flood zone designation, which could entail a lower base flood elevation, or a lower risk zone altogether. Theoretically, this could lead to lower flood insurance rates for homeowners all across the island.

The bad news, as Creef said at the presentation, is that ?Low risk isn?t no risk.? Any resident who is still cleaning up after Matthew, (and there are lots of us), obviously knows that just because a zone on the map has been changed, it doesn?t mean that Mother Nature will refer to the new maps and follow suit. And there?s a concern growing that once flood insurance isn?t required, homeowners may opt out altogether, putting their properties at high risk in the process.

But this is a simple synopsis of a very complex subject, and there are lots of accompanying factors and issues to cover.

So to truly dive into the new flood maps and what they mean, you pretty much have to start with?

The Fundamentals of FIRM (aka, if you?re not sure what FIRM is, then read this section first.)

Before we get into the nitty gritty of the upcoming changes and BOC actions, let?s start with a primer on what some of these figures and acronyms mean.

If you?re anything like me, the very first time you heard a rapid-fire list of the designated flood zones ? like ?AE8, AE9, AE10, VE 10, VE 11,? etc. – your natural inclination was to shout out ?Bingo!? or ?You sunk my battleship!?

But getting a handle on these acronyms isn?t as daunting as it initially appears. Here?s a quick reference guide of the terms that are thrown around when it comes to flood maps:

FIRM ? Flood Insurance Rate Map

FIS ? Flood Insurance Study

BFE – Regulatory requirement for the elevation – or floodproofing – of structures

X and Shaded X Zones ? Low risk area where flood insurance isn?t required with a mortgage. (An X Zone is outside the 500 year floodplain, and a shaded X Zone is within the 500 year floodplain.)

Zones that start with ?V? (aka V and VE zones) ? The most hazardous of the Special Flood Hazard Areas due to wave velocity. Flood insurance is mandatory in these areas. The bottom of the lowest floor elevation must be at or above the Base Flood Elevation level (BFE.)

Zones that start with ?A? (AE and AO zones) ? Also a Special Flood Hazard Area where flood insurance is mandatory. The bottom of the lowest floor elevation must also be at or above the Base Flood Elevation level, and flood insurance is mandatory for these zones too.

Zone AO ? Refers to ?A? zones where average depths are between 1 and 3 feet. (It?s a new designation in the upcoming maps.)

Numbers that correspond with ?A? and ?V? (like AE8, AE5, AE11, etc.) – Refers to the BFE for that zone. So, for example, if you live in an AE5, the lowest livable floor has to start at 5 ft., at the very least.

FFL – First Floor Living area

LAG – The elevation of the lowest ground touching the structure.

Essentially, all properties on Hatteras Island are divided into a flood zone by FEMA, which controls whether you have to buy flood insurance, and where your FFL needs to be to comply to flood insurance regulations.

This guides existing properties, to be sure, but it also guides new construction as well. For example, if you?re in an AE4 zone, then your FFL has to start at 4 ft. or more. Make sense? No? Well, let?s move on anyways.

What?s Changing in the New FIRMs, and When

FEMA tries to update the flood maps every 10 years or so, and the entire process typically takes about 18-24 months. (The last time FIRMs were updated for Hatteras Island and Dare County was 2006.)

At this point, we?re about 6 months into the process. A public appeal / comment process is on the horizon, and should occur sometime in the spring.

On the whole, properties are being moved to less hazardous (aka, hopefully less expensive) flood zones across the county.

A large number of properties were moved from SFHA (special flood hazard areas, or flood zones) and are transitioning as X Zones or Shaded X Zones. ?X Zones and shaded X Zones are significant in that they do not have base flood elevations associated with them, and they typically do not require flood insurance in conjunction with the mortgage on a structure,? said Creef at the meeting.

Also in the numbers, 12,875 buildings were originally listed in AE zones on the 2006 maps, but only 8,493 buildings are listed in AE zones on the new preliminary maps.

And the majority of homes remaining in the AE Zones have dropped in the designated BFE – i.e. a home with the height AE8 may have dropped to a height of AE4.

In the VE Zones, there were 1,828 buildings included on the 2006 maps, and just 124 buildings on preliminary maps. So many of the properties designated VE on 2006 maps have transitioned to AE zones.

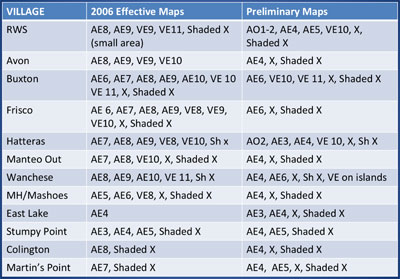

This is a lot of changes to keep track of, to be sure, so here?s a handy chart that Creef included in her BOC meeting that shows what zones are listed in the 2006 maps, and the new preliminary maps:

To make things even easier, Creef also spearheaded the creation of an incredible suite of maps for the Buxton public meeting on January 12 that showed current zones, future zones, and the difference between the two. You can find those here:

Current Classifications — Effective 2006

Preliminary New Classifications — Proposals Only At This Point

Difference In Current And Proposed

Essentially, many Hatteras Island homeowners will likely get a discount on flood insurance under these new guidelines, or won?t even have to purchase it at all.

Preliminary maps, when adopted, should result in flood insurance savings to property owners ? both from new X Zone policies, and a greater separation from first floor living areas to designated BFE. Sounds good so far, right?

But Creef cautioned at the meeting that this may not always be the case, and property owners should talk to their insurance agents about the best possible rate for their properties when maps are adopted. ?Don?t assume that if you?re going to an X Zone that the X Zone policy is going to be cheaper than your AE policy may be. Be sure and talk to your insurance agent to see what your best alternatives are,? she said.

A potential problem also arises with the future building of new properties. For example, if your flood zone is AE4, you might just build your home with your FFL at 4 ft., because that?s what the regulations require and you want to comply. But then your area could experience record flooding, (like what happened literally three months ago), and the main living areas of your home could be destroyed in the process.

Finally, there?s the issue of not opting for flood insurance if you move from a V or A zone into an X Zone, where flood insurance isn?t required at all – And that is a tempting option to be sure.

Living on Hatteras Island is a paycheck-to-paycheck lifestyle for many residents. That?s a given. And if an opportunity arises to suddenly save a few hundred dollars a year on flood insurance, it can be extremely tempting to take that risk ? and especially if you are scraping by, and more immediate needs like food and utilities are far more pressing.

But the fact remains that BFEs may change on a map, but the weather doesn?t.

?The preliminary maps may not accurately reflect the soundside flooding hazards or extreme rainfall amounts such as from Hurricane Matthew,? cautioned Creef.

And being protected if and when the next flood comes has the potential to save a lot of potentially huge problems down the road ? as well as a lot of peace in mind in the meantime.

What Comes Next

During the BOC meeting, Creef outlined six initiatives which were voted on and approved by the commissioners. These initiatives included:

- Invite Spencer Rogers from Sea Grant to an upcoming BOC meeting to discuss possible CRC (Coastal Resources Commission) actions.

- Solicit input from Dare County PPI committee and surveyors/engineers on possible regulatory options. Report back to the Board on input, as well as options for consideration. (The PPI is a committee that was established a couple years ago in conjunction with the CRS or Community Rating System program, which includes local stakeholders, such as engineers, planning board members, insurance reps, home builders, contractors, etc.)

- Apply for additional FEMA mitigation funds for home elevations. ?We?ve been very successful in the past with elevating homes,? said Creef.

- Engage towns to determine what, if any, actions they may be considering.

- Devise a countywide outreach campaign on the importance of flood insurance. All CRS communities do outreach activities, and a concerted effort would result in widespread coverage, and better results, according to Creef. Basically, this initiative ties in with the tagline of ?Low risk does not mean no risk.?

- Advocate for higher ICC funding (increased cost of compliance) as part of NFIP renewal. ?ICC funding is funding that is $30,000 associated with every flood insurance policy, and it is used to assist and offset cost associated with elevating your home or demolishing your home and replacing it with a compliance structure,? explained Creef to the BOC.

- ??I?m involved in ICC claims, and I?ve been working with property owners to get that money. And since Hurricane Matthew, I?ve written 40 to 45 letters for property owners down in Hatteras and Frisco, and the one [sentiment] I always hear from folks is ?Donna, that $30,000 just isn?t going to cover the cost.’ So maybe it?s appropriate for us to lobby our congressional representatives and see if we can?t get that $30,000 increased as part of that renewal of the national flood insurance program.?

Board members voted to approve the aforementioned actions, and weighed in on the new FIRMS as well as what they?ve seen in the local communities, in terms of responses to flooding.

?I took a ride through Hatteras, and there?s currently 11 houses that are on the way [to] being raised, so they?re getting it,? said Board Member Danny Couch. ??Matthew was kind of an epiphany, and a lot of these people are motivated, and there?s at least twice [that number] that the three major house movers down there are lining up for business… It?s coming to the point where a lot of the homeowners there are saying ?I?m not doing this anymore.??

What You, as a Homeowner, Need to do in the Months to Come

You have time to address the new FIRMs, to be sure.

The public comment is still a couple of months away, and the new flood maps won?t go into effect for another 12-18 months or so.

Even so, advanced planners will want to keep the following in mind to determine how to save money, keep themselves protected, or ? hopefully ? all of the above.

- Talk to your existing insurance agent to see if and how your policy could change, and to research cost saving options as needed. The public meetings were well attended by local insurance agents, so they?re in the know on what?s going on.

- Consider getting a new elevation certificate if the upcoming cost savings are worth it. As County Commissioner Bob Woodard pointed out at the meeting, a current elevation certificate will be needed to get rated for folks who transfer from a higher risk flood zone to a lower one. ?That?s a cost that hopefully will be worthwhile to pay ? toget the elevation certificate done,? said Creef. ?[That way,] you can take it to your insurance agent, and the rate will drop, and it will cover that cost of the elevation certificate within that first year.?

- If you?re thinking about buying or selling a property in the next couple of years, talk to a Hatteras Island Realtor. At the Buxton meeting, Realtors from veritably every local company were in attendance to make sure they knew what the changes entailed, and every sales agent I talked to at the meeting attested that it?s their job to knowthe ins and outs of flood maps, so they can best help their clients. Suffice it to say, the Realtors down here know their stuff.

Yes, worrying about the implications of the new FIRMs may seem premature at this point ? especially considering we haven?t even reached the public comment period yet.

But considering that the new flood maps are showing lower risks across the board, and the island is still reeling in some places from record flooding, it seems as good a time as any to know as much as possible, take stock, and to be prepared for changes to come.