HATTERAS ISLAND FLOOD MAPS

Roughly 50 members from the Hatteras Island community – which included Realtors, business owners, surveyors, local insurance companies, and other professionals – attended a meeting on Thursday, Jan. 12, all about the new preliminary Flood Insurance Rate Maps (or FIRMs) that were introduced on June 30 of last year.

The meeting, which was held by N.C Emergency Management in conjunction with staff from the Dare County Planning Department, was structured to provide an overview of the procedures guiding the new FIRMs’ development, as well as to answer questions from the island community about how local residences and businesses would be affected.

“The purpose is to get the info out to everyone who will be affected by the maps,” said Dare County Emergency Management Director, Drew Pearson. “The maps are in the preliminary stage – before the appeal and comment period – and we want to let people know what’s going on with the changes.”

“Flood insurance is critical for people in Dare County, and especially on Hatteras Island,” he added.

Dare County Planning Manager Donna Creef noted at the onset of the meeting that the entire process to convert to the new FIRMs takes roughly 18-24 months, and Dare County was currently in about month six of the process.

The FIRMs are updated every 10 years or so, and the last update for the county was in 2006. The next step after this preliminary stage is to initiate a 90-day public comment and appeal period, which is scheduled to occur in March or April. After this period, FEMA resolves any comments and appeals and makes changes to the FIRMs as needed.

The difference between appeals and comments essentially boils down to the data used to back an objection. An appeal is based on empirical data that show the proposed Base Flood Elevation (BFE), Special Flooding Hazard Area Boundary (SFHA) boundary or zone designations, or regulatory flood designations are scientifically or technically incorrect. A comment is an objection that is not related to BFEs or modified SFHA designations. According to a hand-out provided at the meeting, comments generally involve mislabeled maps, such as incorrect corporate limits, extraterritorial jurisdiction boundaries, road names or locations, as well as any other possible omissions or potential improvements to the mappings.

Steve Garrett, Outreach Planner and OMC Manager/Community Development Planner II for the N.C. Floodplain Mapping Program, and Tyler Longberry, an engineer working with North Carolina Emergency Management, both spoke at the roughly 1-hour presentation that preceded the public question period.

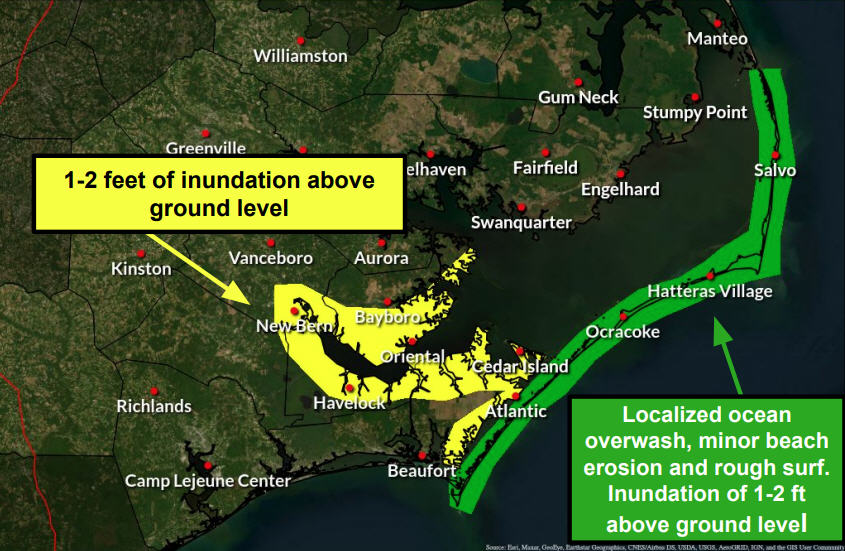

Longberry outlined the methods utilized to create the flood maps – which relied on historical data based on past flooding from storms and hurricanes, as well as data from national organizations such as NOAA.

Garrett briefly reviewed the stages of implementing new flood maps, and covered the various flood zones. A “VE” flood zone, the most risky, can be subjected to wave height that’s more than 3 feet above base elevation levels. An “AE” zone is between a 0- and 3-foot wave height, and an “X” zone is a locale that sees a massive flood once every 500 years or so. A new “Coastal AE” section was introduced as well, which is an area that is essentially at greater risk than AE.

Garrett also produced a sample flood policy for homes in each of these regions, and noted how properties that are above the BFE – which on Hatteras Island basically means properties that are on pilings – have flood insurance rates that are drastically reduced. For example, a flood insurance policy that cost roughly $2,100 at BFE would be reduced to $570 if the residence was 4 feet or more above the base elevation.

Recent 2012 and 2014 legislation that changed flood insurance rates for buildings that were constructed before an effective date for a community’s first flood insurance map — also known as pre-FIRM — as well as the flood insurance cost difference between primary residences and vacation homes, was also touched upon. Particularly, Garrett pointed out that the insurance surcharge that went to bolster funds for catastrophic events – such as 2005’s Hurricane Katrina – was $25 for primary residences, and $250 for non-primary residences.

Another large topic that was covered in detail was the concept of grandfathering, and how current flood insurance policy holders could use grandfathering as a cost savings option for any future flood map adjustments.

When a FIRM map changes, NIFP provides lower cost flood insurance options available for homeowners who have flood insurance policies already in effect, and / or who have built in compliance with the flood map in effect at the time of construction to lock in the earlier BFE or flood zone to calculate their insurance rate in the future. This option could result in significant savings. More information on grandfathering, and how an insurance is affected or can be adjusted when a new FIRM is implemented, can be found online at https://www.floodsmart.gov/floodsmart/pages/understanding_flood_maps/map_changes_flood.jsp.

In addition, for properties that change from moderate / low risk areas to high risk areas, rating options can offer savings, according to a hand-out that was distributed at the meeting. Buildings newly mapped into a high-risk area may initially be eligible for a lower-cost rate during the first 12 months following a map change. Premiums will then increase up to 18 percent each year as part of the premium rate revisions put in place by the Homeowner Flood Insurance Affordability Act of 2014. Essentially, purchasing a policy before the new map goes into effect will maximize savings. Your insurance agent can provide more details on how to save, and for homeowners who are selling a property, a policy can be assigned to new owners, allowing them to keep the lower rate.

The complete brochure with information on how to respond to map changes can be found here. https://www.fema.gov/media-library-data/1428946481046-dac9e1fc4a07f4e0ca70fcc610f74775/FEMA-HFIAA_MapChangeFS_040715.pdf.

Garrett also advised attendees to check out their properties at http://fris.nc.gov/fris/, which has detailed info on risk information for all properties on Hatteras Island. (Browsers should note that the address search may not always be accurate, so a little zooming in may be required to pinpoint and acquire information on a specific locale.)

The roughly hour-long presentation provided a ton of data on both the process and potential effects, but the town-specific maps that were generated by the Dare County Planning Department, and which were hung all around the walls of the Fessenden Center, provided to be very helpful for many attendees.

After the presentation was over, visitors went to the maps – which showed, individually, the current flood maps, the “new” preliminary flood maps, and the difference between the two – and identified their own property to see if anything had changed.

Garrett, Longberry, and Donna Creef from the Dare County Planning Department also fielded individual questions from participants, who asked if their designated area had changed, and if so, what they should do next.

For many folks at the meeting, however, their attendance was due to the fact that knowing and understanding this information would help them perform their day-to-day jobs better.

“We have to be able to explain [the FIRM changes] to people who own property here,” said Hatteras Realty real estate agent Bob Barris. “And we’re incredibly lucky that we have such a great number of professionals who recognize that it’s important to be here.”

“It’s a salute to our Dare County Planning Department for making sure our property owners understand the impacts of the pros and cons of these changes,” said Dare County Board of Commissioner and Realtor Danny Couch. “I’m happy that Dare County has taken a leadership role helping property owners understand the insurance ramifications that these changes may have.”

The 90-day comments and appeals process will be announced and advertised in the near future.

To determine whether the flood zone for your property has changed, you can check both the current, effective flood map and the new, preliminary map at the NC FRIS website listed above. Or if you live in or own property in unincorporated Dare County, you may contact the Dare County Planning Department at 252-475-5873 and planning staff will assist you with identification of the flood zone for your property.

HATTERAS ISLAND FLOOD MAPS